Another year full of challenges and new projects has passed, in which we have been moving ever faster to meet the expectations of our financial industry customers. One such project is the intensive development of the mobile application of our long-standing client, SGB-Bank SA.

The latest implementation has brought us all a lot of satisfaction. Its effects have also been recognized (third time in a row!) by the Mobile Trends Awards jury, with a nomination for the best mobile banking app in the mobile banking category!

2023 milestones

In 2020, SGB-Bank challenged us to create a mobile app in 6 months. He trusted our #AilleronExpress and proven Design Sprint methodology... so our adventure began 😊.

Since then, we have implemented several specific improvements and innovations. What brings them together is implementing the latest technologies and creating a unique user experience.

What did the SGB Mobile app do to deserve a third consecutive nomination for the Mobile Trend Awards? See for yourself; 2023 was a really busy year.

April 2023 – Visa mobile

This is an additional online payment form with authorization directly in the app. It allows you to make quick payments without entering your card number and, therefore, is more efficient than paying by card online.

April 2023 – Currency exchange (“Kantor SGB”)

The following currencies are available at “Kantor SGB”: PLN, EUR, USD, NOK, GBP, DKK, SEK, CZK. The service is available to holders of foreign currency accounts who simultaneously hold a PLN account with Internet access.

September 2023 – Expenditure/Expenses analysis

The categorization module was developed by the Aileron team, which specializes in AI issues. It creates the possibility of assigning expenses to a defined category and analyzing these categories in the form of clear charts.

September 2023 – Recording receipts

A module using a third-party solution to add a photo of the receipt in the application. Based on the receipt, the module analyses the expenditure and assigns each product to the appropriate category (e.g., groceries, rtv/agd, travel, etc). Thus helping users to plan their expenses more effectively.

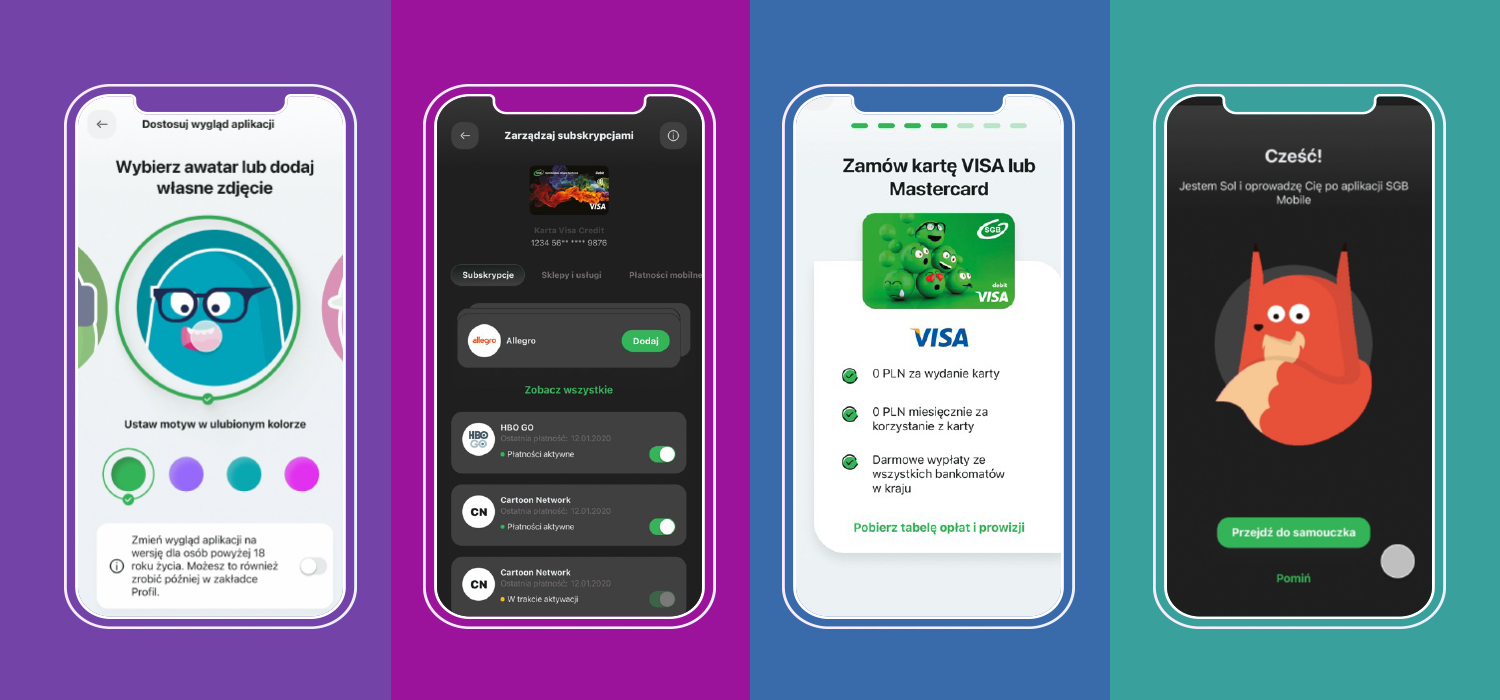

December 2023 – Personalised look and app for children

App users can customize the layout of the desktop according to their needs and habits. Personalization applies to three areas – favorite color theme, customization of the desktop and quick actions bar, and support for dark mode.

Development of the SGB Mobile app for children

This is one of our favorite projects 😊 In line with the latest trends in mobile banking, SGB has set its sights on developing the app with the youngest users in mind. The goal? To build good financial habits in children and support parents as they introduce them to mobile banking while retaining full control over their pocket money.

From December 2023, every SGB co-operative bank that has an SGB Mobile app can offer the young user of its app:

- choosing their unique avatar (as in other non-financial apps in which youngsters have fun and learn every day);

- setting their favorite color scheme (including a dark mode) and personalizing the desktop layout (quick actions bar and attractive widgets);

- a fox named Sol, a mascot who guides children through the world of finance and the possibilities of their friendly banking app.

Additionally, every child using the SGB Mobile app will learn how to manage finances handed over by their parents and how to customize the app’s functions to suit their unique needs. When the account user reaches the age of majority, the account will automatically change to a fully functional bank account. So, sound habits can pay off in adult life 😊.

The app also has a panel for parents that provides control over children’s finances and insight into receipts, spending, and transactions, as well as allowing them to manage card and BLIK limits.

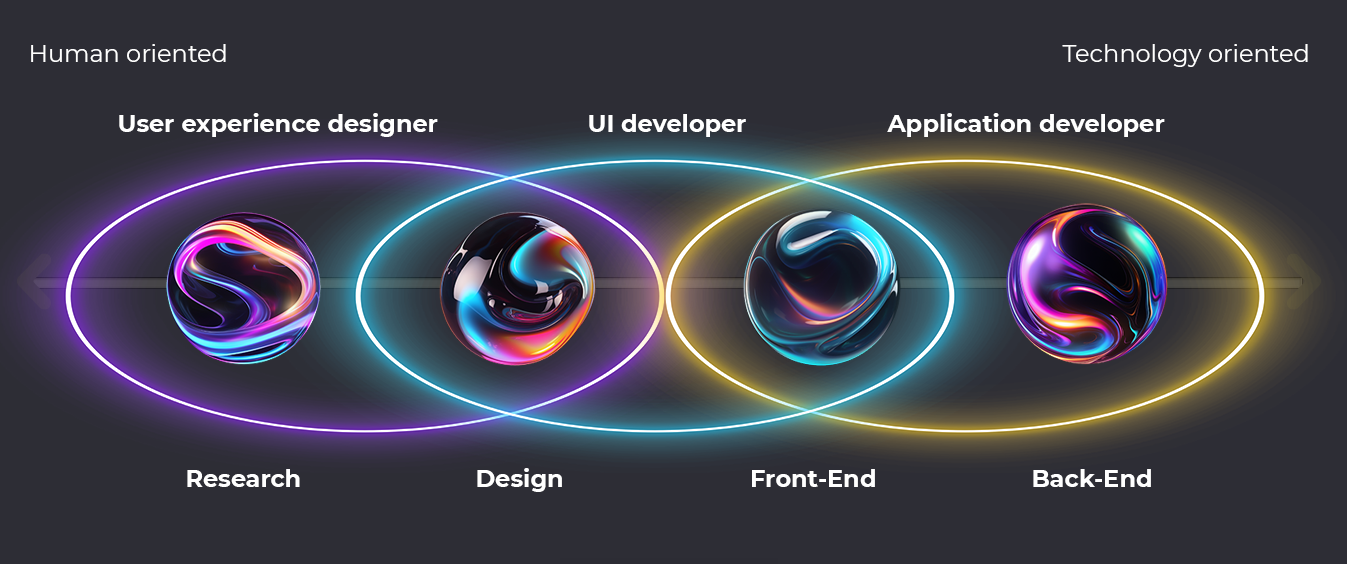

How we worked to develop SGB Mobile?

In developing the concept of a banking mobile app for children, we focused on:

- creating an app that addresses the most essential needs of our future users;

- ensuring that each user could personalize and customize the tools;

- providing modern services, not just banking ones, to be used by the youngest.

The first stage of the work to build the children’s app was to collect data on the needs of potential users. Our research included:

- Surveys to determine children’s and young people’s banking needs, what they associate finance with, and how they would like to customize the app.

- Moderated and unmoderated usability tests of the app prototype, in which we positively validated the concept of a banking app for children.

We took the data collected during the testing to the Design Sprint workshop.

The conclusions from the workshop allowed us to develop the main business assumptions and make key design decisions. This led us to create a new version of SGB Mobile adapted to the needs of the youngest users, which builds good habits and financial well-being.

Download Ailleron – SGB case studyResults that please those small and big ones 😉

The possibilities of the new application – “Takie Konto Spoko”:

- Remote account opening by child or parent

- Ordering a payment card online

- Electronically transfer documents

- Quick onboarding process – 100% online

- Simple customization of the app’s layout

- Support for the popular dark mode

- Choice of your own avatar and color theme

- Selecting action shortcuts on the desktop

- New personalized application desktop

- Application guide – a fox named Sol (only in the children’s app)

Parent panel:

- Creation and activation of the child’s account

- Access to the child’s account history

- Management of cards and card services (3DS, subscriptions)

- Control of card and BLIK limits

- Management of the child’s BLIK service

- Authorisation of the child’s orders (multi-signature)

Please find out more about this implementation on our partner’s website.

Are you building a new mobile application or looking to upgrade your current mobile banking solution? You will find us here!

Polski

Polski

Deutsch

Deutsch