The European Accessibility Act (EAA), which came into force on June 28, 2025, marks a new chapter in digital product design across the banking industry. While many still perceive these regulations primarily as a legal obligation, they in fact open the door to significant business opportunities. Financial institutions that once treated the Web Content Accessibility Guidelines 2.2 (WCAG 2.2) as a formality are now discovering that accessibility can become a powerful growth driver: one that expands the reach of their services, increases customer satisfaction, and directly contributes to revenue growth.

Table of Contents

- Accessibility as a Business Driver

- A Shift in Perspective: From Obligation to Opportunity

- The Business Benefits of Accessible Design

- Expanding the Target Audience

- Increasing Conversion Rates

- Reducing Customer Support Costs

- Strengthening Loyalty and Brand Reputation

- The POUR Framework: A Practical UX Compass

- From Concept to Practice: Our Project Experience

- Challenges and Best Practices

- The Future of Digital Banking

- References

Accessibility as a Business Driver

For many organizations, digital accessibility was long perceived as a business constraint, an additional cost, and a limitation on designers’ creativity. In reality, the truth couldn’t be more different: accessibility-driven design is simply good design. A clear information hierarchy, intuitive navigation, and visual simplicity not only make life easier for people with disabilities but also enhance the experience for all users. In banking, where trust and interface clarity are the foundation of success, accessibility becomes a natural competitive advantage. The easier it is to access banking services, the stronger the customer’s trust, and that trust directly translates into tangible business results.

A Shift in Perspective: From Obligation to Opportunity

As designers, we’ve observed a fundamental shift in mindset: accessibility is no longer just a checklist to complete before an audit. It’s becoming a design strategy that drives business growth and product innovation. Implementing WCAG 2.2 is not only about meeting legal and regulatory requirements; it’s an opportunity to create better products for everyone. Temporary limitations affect all of us, without exception, whether we’re using a mobile app in bright sunlight or navigating it on public transport. Designing with accessibility in mind helps eliminate potential obstacles and ensures that interfaces remain intuitive and functional for all users.

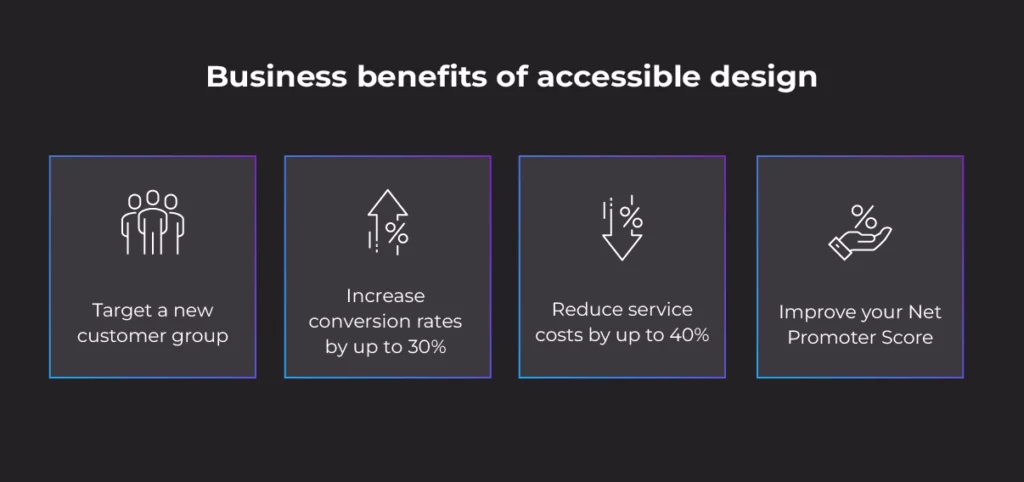

The Business Benefits of Accessible Design

Expanding the Target Audience

In Poland, approximately 5.4 million people live with various types of disabilities. It’s a significant market segment that has historically been overlooked. WCAG implementation opens access to key user groups, such as:

- People with visual impairments – over one million users, particularly within older demographics.

- People with permanent or temporary motor disabilities – who benefit from alternative navigation or input methods.

- Neurodivergent users and those with cognitive challenges – for whom intuitive layouts and simplified language improve comprehension and confidence in financial decisions.

Increasing Conversion Rates

Research shows that accessible websites and mobile apps can achieve conversion rates up to 30% higher. In banking, where each customer’s annual value may reach tens of thousands of złoty, even small improvements in conversion, for example, in account opening or loan application processes, can have a tangible impact on revenue.

Moreover, WCAG-compliant products tend to be better structured, easier to scan, and more readable for search engines. This leads to improved SEO performance, lower bounce rates, and stronger visibility online.

Reducing Customer Support Costs

Accessible, intuitive interfaces reduce the number of support inquiries and lower customer service costs by as much as 40%. Employees can then focus on complex cases rather than answering repetitive “how do I…” questions. This not only cuts operational expenses but also improves job satisfaction and customer trust.

Strengthening Loyalty and Brand Reputation

Accessibility builds loyalty. When banking interfaces are easy to use, clearly worded, and visually coherent, customers are more likely to recommend them. Studies show that accessible design can significantly boost the Net Promoter Score (NPS) and improve long-term retention rates.

The POUR Framework: A Practical UX Compass

The POUR principle (Perceivable, Operable, Understandable, Robust) is a practical guide for UX designers implementing digital accessibility standards:

- Perceivable – Clear, legible content builds trust and confidence. Examples include properly structured headings, descriptive alt texts for icons, and sufficient color contrast.

- Operable – Smooth navigation, responsive forms, and full keyboard and gesture support enhance usability and encourage conversion.

- Understandable – Consistent language, clear instructions, and predictable feedback messages reduce user frustration and error rates.

- Robust – Semantic code and cross-device compatibility ensure durability, flexibility, and long-term scalability.

From Concept to Practice: Our Project Experience

Our projects demonstrate that accessibility translates directly into measurable business results. In the SGB Mobile Banking application, for example, we implemented a system that serves 1.5 million users within six months. Thanks to intuitive navigation, responsive design, and a simplified onboarding process, user satisfaction and engagement increased significantly.

We’re also developing AI-powered solutions, such as automated transaction classification and smart, personalized interfaces, ensuring that advanced financial functionalities remain accessible to every user.

Challenges and Best Practices

When implementing accessibility, the biggest challenge isn’t usually technical; it’s cultural. The key is to build organizational awareness that accessibility drives innovation, improves brand image, and creates better products for everyone.

Best practices include:

- Comprehensive education across teams and departments, to build a shared understanding of accessibility’s business value.

- Balancing functionality with aesthetics, where accessible interfaces can (and should) be visually appealing.

- Continuous testing with real users, including people with disabilities and neurodivergent individuals, to identify usability barriers early.

The Future of Digital Banking

The current WCAG 2.2 guidelines provide a robust foundation, but the upcoming WCAG 3.0, still under development, will introduce a major shift in how accessibility is measured and applied. A flexible scoring model will replace the existing rigid A/AA/AAA system. At the same time, the scope of the guidelines will expand to encompass emerging technologies, ranging from voice banking to AR and VR. The key difference will be a shift in focus from technical compliance to the actual user experience.

The financial sector is once again facing a technological turning point. Banks that adopt inclusive design strategies early on will gain a lasting competitive advantage. It’s not a question of “if,” but of “when.” The European Accessibility Act, effective from 2025, marks only the starting point, not the final goal. While global regulations such as Section 508 in the US and the Accessible Canada Act have been shaping their markets for years, Polish banks now have an opportunity to seize this moment when accessibility is evolving from a legal requirement into a driver of better product design.

Evidence speaks for itself: early investment in accessibility increases conversions, reduces future redesign costs, and enhances customer satisfaction. It’s a compelling opportunity to build financial solutions that truly serve everyone and set a new standard for digital banking in a connected world.

Don’t Just Meet the New Standards. Lead the Change and Unlock the Business Potential of Accessibility

Contact our UXLab Team!FAQ

References

- U.S. General Services Administration. The Benefits of Accessible Design. https://www.section508.gov/blog/benefits-accessible-design/

- Testparty. The Business Case for Digital Accessibility. https://testparty.ai/blog/the-business-case-for-digital-accessibility

- PayPal Business Resource Center. How Accessibility Impacts Conversions. https://www.paypal.com/us/brc/article/accessibility-impacts-conversions

- Accessibility Test. The Top Benefits of Accessible Websites in 2025. https://accessibility-test.org/blog/industries/the-top-benefits-of-accessible-websites-in-2025

- Accel Fintech. Case Study: How a UI/UX Redesign Boosted Sales. https://accelfintech.com/insights/case-study-ui-ux-redesign-boost-sales

- Hypersense Software. The Business Impact of UX Design. https://hypersense-software.com/blog/2024/05/17/business-impact-ux/

- UX Insight. Five Arguments to Sell Accessibility to Your Company. https://uxinsight.org/5-arguments-to-sell-accessibility-to-your-company/

Polski

Polski Deutsch

Deutsch