Why is there a need to create high-quality ML models?

In recent years, the number of banks leveraging the potential of machine learning models (ML models) has increased noticeably. According to the Evident Insights report, American financial institutions are leading in adopting solutions based on this technology. The most common use cases include investment advisory, chatbots supporting customer service, and fraud detection mechanisms.

As a provider of IT solutions for the financial sector, we have observed a growing interest in leveraging machine learning capabilities to synthesize data from diverse sources for service personalization. In personal banking, customizing offers is crucial to modern banking, tailored to each customer’s unique needs. Achieving it requires a deeper understanding of client preferences, predicting their needs, and early risk mitigation.

According to the PwC report, 61% of bank managers consider service personalization important, yet only 17% confirm their organization has the right tools to individualize marketing communication. In particular, the situation in the Polish market shows that this business need isn’t adequately addressed, and banks lack comprehensive solutions.

Our offering aims to bridge this market gap. We recognize that to foster trust in personalized banking services, we need high-quality models that provide accurate suggestions and the right product recommendations. In turn, to achieve high-quality ML models, it’s essential to use the bank’s most complete customer data and identify the links between this information.

Graph neural networks – what are they, and what capabilities do they offer?

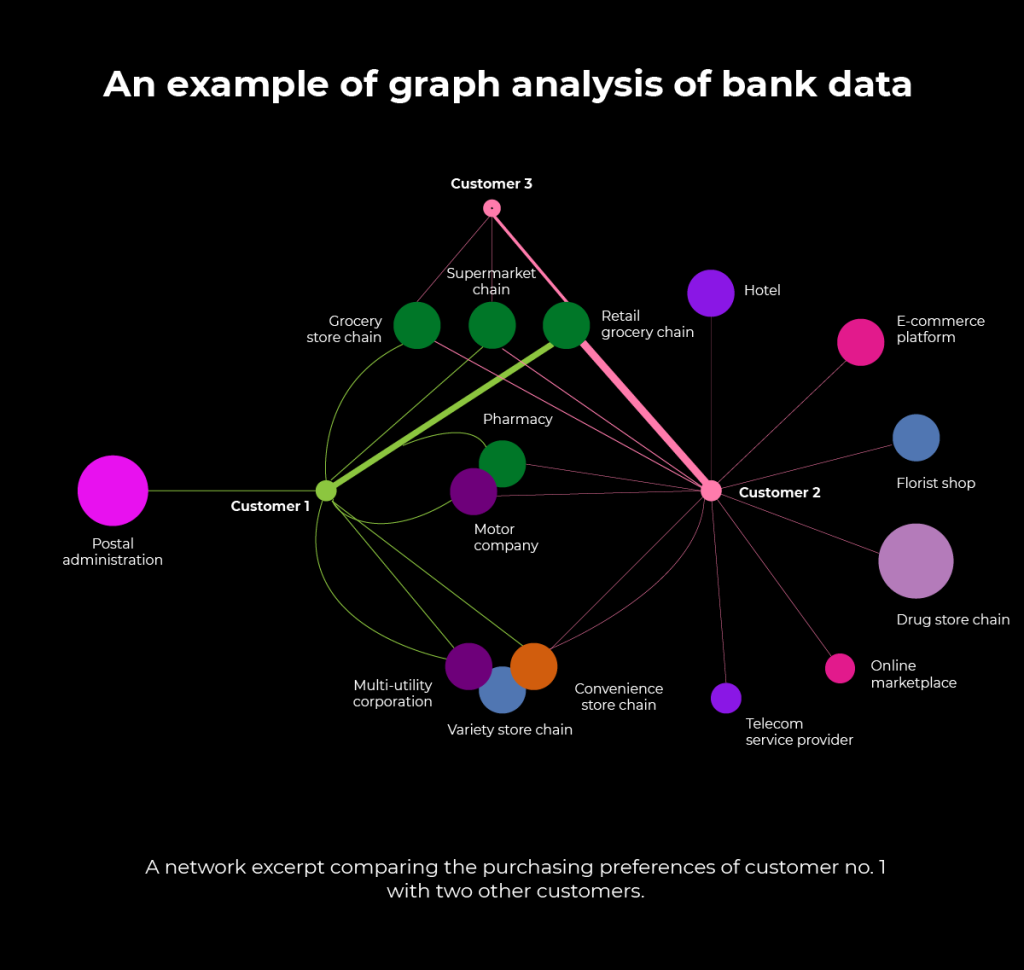

Through analyzing available sources and conducting preliminary research and development, we have determined that the optimal approach is to use a graph representation of customer data along with Graph Neural Networks (GNNs). This machine learning technique excels at representing complex relationships between data points. Graphs are structures consisting of nodes (also called vertices) and edges connecting these nodes, and GNNs focus on efficiently modeling the relations between nodes and edges in such structures.

Financial institutions use numerous IT systems to manage bank accounts, support credit processes, handle cards, detect fraud, manage financial accounting, online and mobile banking, conduct marketing campaigns, and maintain customer relations. The excess of dispersed sources complicates data exploration, which is why data warehouses are used for analytical purposes. While these warehouses aggregate resources and partially filter data, this process often diminishes the quality of ML models trained on these datasets.

Graphs provide a precise representation of the “customer environment”, referring to the customer data that can be retrieved from various banking systems. Unlike current market solutions, the knowledge graph is purpose-built for creating ML models rather than business analytics. It means that the data needed to train ML models will be preserved (e.g., we won’t lose the characteristics of individual transactions during data aggregation).

Using graph structures in consumer banking

Traditional machine learning techniques cannot effectively generate recommendations or predict behaviors for customer types that are underrepresented in the training data. Unlike standard ML models based on simple vector representations of customer characteristics, GNN emphasizes the spatial structure of the data. It enables a deeper understanding of the facts and sequences of events characterizing customer behavior, allowing for more accurate forecasting of future actions.

The flexibility of heterogeneous graphs (i.e., those containing different types of nodes) allows for:

- defining a universal graph representing comprehensive knowledge about a banking customer,

- detailed analysis of relations between data,

- extending customer insights through integration with additional data sources and auxiliary ML models.

Knowledge graph representation and GNNs in banking

At Ailleron, we’re working on a methodology for creating a graph-based representation of data about banking customers, i.e., aggregating data from various sources into a heterogeneous knowledge graph. These graphs enable using the collected data to build various models (e.g., for product recommendations, behavior prediction, etc.) by applying traditional neural networks and GNNs.

According to the business environment analysis, GNN models aren’t commercially used in Poland for the above-described applications. Aiming to enhance Ailleron’s competitiveness, expand our AI and ML service portfolio, and promote this innovative approach in both domestic and foreign markets, we’ll persist in R&D in this area.

To improve digital services for individual banking, we’ve partnered with Nethone, specializing in analyzing the behavior of online service users to detect fraud attempts and impersonation of real customers. Nethone has consumer behavioral data, which can be used for advanced analysis such as segmentation, product recommendations, and behavior prediction. The collaboration involves mutual knowledge exchange, Nethone’s contribution of a data storage structure to enrich the customer knowledge graph with behavioral biometrics information.

GNN application in banking

So far, the representation of customer data mentioned above has not been widely used in banking. Technological giants such as Google (Alphabet), Microsoft, and AWS are mainly focused on universal models and platforms.

In creating graph-based representations of customer knowledge and GNN networks for predicting behavior, tailoring the methodology to the industry’s specifics is crucial. Otherwise, we may achieve lower effectiveness because universal solutions work on generic data, such as owned products or customer attributes like age, gender, education, income, profession, etc., without encompassing information crucial for financial institutions. Transactional data, in particular, is a source of valuable knowledge as it reveals what goods and services customers spend their money on and where they make purchases.

Graph neural networks for finance – Summary

We recognize the innovativeness and significant potential for transforming the existing target market through applying GNN networks. Advanced ML models enable creating more effective tools for analyzing customer behaviors and tailoring banking offers to their expectations, complementing Customer Data Platforms with deep data relationship analysis. According to our presumptions, GNNs will allow enriching information with knowledge from other models.

We always listen to our audience’s needs and plan to explore further various possibilities to combine graph-based data representation and generative AI to develop advanced solutions such as chatbots, videobots, conversational banking interfaces, and data extraction.

After finishing our research and development and obtaining results for model parameters, we’ll be prepared to distribute our developed solution widely. Ailleron’s offering will address the genuine needs of the banking and financial industry, which is focused on digital transformation, improving customer experience, and streamlining transaction analysis processes.

Sources:

[1] Report: Digital Banking and Beyond: The Value of Personalization, Strands and PwC, 2023

[2] Report: Evident AI Index Key Findings, 2023

Polski

Polski Deutsch

Deutsch