Understanding your client starts with listening, market research, and following new trends. In 2023 Ailleron commissioned the ICAN Institute to conduct a market study on leasing end-customers, and we’ve written a lot about it. Finally, we decided to organize a webinar with one of the most prominent leaders in the digitalization of the financial sector, Raiffeisen Leasing and UniCredit Leasing. We wanted to talk with our partners about the report’s conclusions and the perspective for the customer self-service portals in digital and extremely dynamic times.

We aimed to juxtapose the customer’s voice with the market’s first-hand. This has brought us to the conclusion that the need for digital acceleration in leasing is no longer abstract. It is here, driven by your customers, and requires your action now.

Where did we start with our insights, so useful for customer self-service portals?

In the ICAN research, 300 companies from the Polish leasing industry (among Polish B2B decision makers, micro – SME – large companies) talked about their experiences with digitalization and the implementation or consideration of implementing the customer self-service portals or other digital leasing solutions. Thanks to this, we’ve learned how to win more leasing clients in 2024 and were very enthusiastic about sharing our insights with our global leasing business partners.

At the webinar conducted on March 26, we invited influential orators. Our well-known to all our leasing clients and partners – Kamil Portka, General Manager of our LeaseTech, has proven to be an excellent host. In turn, our webinar partners are top professionals from the financial industry, business, and digital-oriented global managers, as well as practitioners who manage the development of leasing products on a daily basis. Peter Heinzl– Head, Product&Channel Management, represented and shared good practices of Raiffeisen Leasing and the same Angel Penev – CE & EE Director Leasing Solutions of UniCredit Leasing.

Interestingly, we recorded a 50% high attendance rate (participants from different European countries), and those who couldn’t attend live asked us for the recording very quickly. All the indications are that we hit the mark with the teaming and composition of our brainstorming session.

Online or not online…self-service platform or business relations

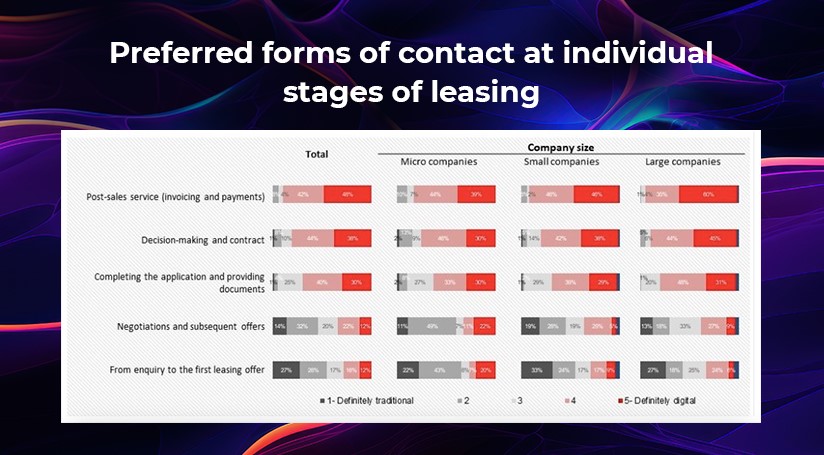

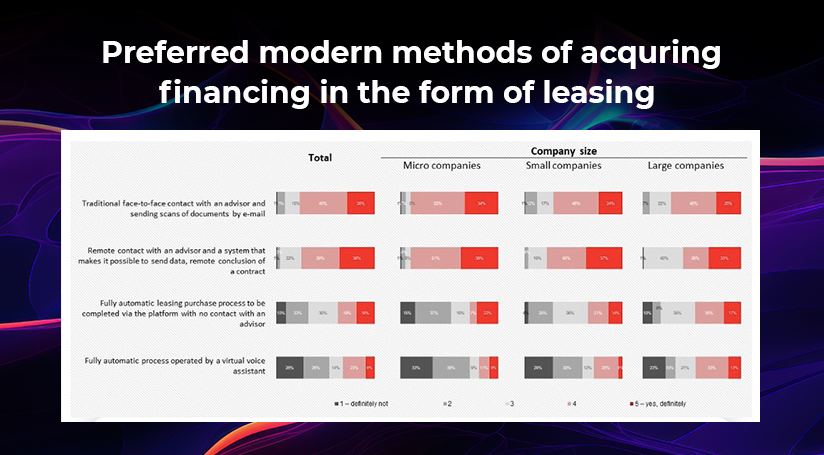

We started with a critical question: Are European leasing companies ready to switch to 100% online? The paperless and self-service approach in independent leasing companies can enormously streamline leasing processes. According to our report, 63% of end leasing customers would like to complete a leasing transaction 100% remotely. At the same time, the leasing industry isn’t quite ready for that, but it might be with the equipment finance ecosystem of software. That’s why our partners are intensely focused on developing customer self-service portals and implementing innovative digital leasing solutions.

Also, it’s worth noting that the most desired form of getting new contracts is between 100% online and with the support of a salesman. So, standard support and building strong relations with your clients are critical in phases like negotiations and subsequent offers or guiding from the inquiry to the first leasing offer.

What I’m seeing on the Austrian market is that (…), there is a big difference between leasing products because most of the digital effort in the Austrian market goes into digital solutions for vehicle leasing. We only have a little bit of equipment leasing, and we don’t have many digital solutions for real estate products so far. However, we do see a growing need for self-service solutions, especially in the B2B area, and for eKYC and document handling solutions, which is relevant to the Austrian market.

When it comes to 100% remote or what we call end-to-end leasing solutions, we already have it in some of our markets for specific financial asset types. But 3 factors need to be taken into account. The first is the asset type, whether automotive, equipment, trucks, or trailers. Secondly, what is the standard, level of standardization in these assets? And finally, what is the sales channel? (…) We see that in the offering or quotation, the more advanced customers want to receive an offer online, but as they progress, they are gradually taking it all offline in terms of discussion with the advisors.

Are you curious about Ailleron’s answer to all these digital challenges and our approach to customer self-service portals? At Santander Leasing, BNP Paribas Leasing Solutions, or PKO Leasing, we’ve created and are constantly developing services and solutions that are already improving leasing processes and the equipment finance ecosystem. Read more about our ready-to-use LeaseTech Customer Platform here.

Support for sales and customer services with an omnichannel approach

Sales have been about building trust and good customer relations for ages. While omnichannel digital solutions are extremely helpful in simple and repetitive tasks, especially with post-sales leasing processes, the human touch and professional know-how or experiences from your leasing consultant still matter a lot.

We see that many customers, especially in the micro, SME segment, and vehicle leasing, are willing to start the leasing customer journey digitally and then go offline. Therefore, it is a big challenge for us to master that and get a seamless customer journey. It’s about managing the touch points for customers and the different stages of the journey, and it’s relevant for success and great customer satisfaction

Moreover, financial institutions must improve all communication channels (phone calls, email, face-to-face meetings with advisors, text messages, online forms, video conferencing, chat), and customers want to use most of them in 3 years. It might be a lot easier to keep track of these trends if you get to know the LeaseTech Customer Platform or the LeaseTech Virtual Branch – and become friends with it. 😉

Customers require the leasing company to be present on each of the communication channels, pick up the data, and be able to have an insightful conversation with them. If they switch to a different channel, they do not want to start explaining themselves from scratch. We are trying to invest in all solutions supporting omnichannel leasing services for them.

What modern communication tools do customers want?

Remote video contact seems to be the most attractive for the customer at the first stages of the leasing process and for negotiating offers. According to this, we need to dive deep into the new role of leasing advisors. How will this role change? During the webinar, we wondered which digital tools can support your leasing advisors the most efficiently in focusing on what matters and what increases the loyalty of your leasing customers and brings you new ones.

The way you interact with customers today is basically in combination with the customer portal, where the customer has their own platform, can log in, see certain offers, book an appointment, or book a video call. And then interact with the advisor. That will happen more and more, and certainly, we will follow that trend. Still, all the other channels, phone calls, and emails will remain. What we think will happen is that the advisor will still be at the center of the interaction with the customer.

I think that for a leasing company or a bank, we have to ask ourselves where we have a traditional face-to-face offering and where we have digital solutions. Ultimately, our customers don’t care which portal or digital tool they use. They want a solution to their problem, which is our biggest future challenge. We are not there yet, but we’re working on it.

We’ve also asked our speakers if they believe in dedicated mobile leasing applications. Both Raiffeisen Leasing and UniCredit do believe in mobile leasing solutions, but also the desktop version. As we concluded, the customers should decide which is more suitable and efficient for them, but mobile is a vital and promising channel/communication tool.

In light of the above, the role of the sales consultant will change hugely. As personal relationships are still crucial, mainly for corporate customers and more specialized project finance types, a new way of technologies like video conferencing is also essential. When we look at lower-value transactions and some standard tasks or smaller leasing companies, they start the customer journey online via a quotation offering tool. AI solutions, like AI-driven platform data or chatbots, will play an important role in the future for both cases, to master effectiveness and cost efficiency in the financial and leasing industry.

The main areas of AI development for UniCredit are risk management, i.e., underwriting and residual value management, and in some cases, compliance and eKYC. However, a lot also depends on data availability and quality because some data still requires human interaction to understand the customer entirely.

At Raiffeisen Leasing, AI solutions are first used internally. Then, AI is used to improve the customer experience and customer satisfaction. One of the most significant current topics is automatic authorization for customers within their digital journeys.

Meanwhile, at Ailleron, the hottest topic is the AI prompter. Designed and developed to obtain brief information about the customer, regardless of the point of contact, salesman, or contact center agent.

The conclusion?

Our insightful webinar ended with a couple of main conclusions.

- Customers will use more and more communication points and expect the highest quality in all of them.

- Customer self-service portals, AI solutions, and the right business partner will be priceless for innovative and digital leasing companies in the future.

Are you interested in how we can serve you? Check out our solutions and vast leasing portfolio management software.

Polski

Polski Deutsch

Deutsch