According to a recent Forrester blog, “almost half of Canadian, French, and UK online adults who are banking customers think that all banks are the same.” Things can get even worse for financial institutions; that is because majority of consumers believe that large banks are not trustworthy1. However, leaders in the industry are rarely concerned with this state of things. Can it be changed, and why should it?

Sustainability is a new priority

Banks’ public image leaves much to be desired. Despite trying to improve their perception, some banks contribute to a number of negative phenomena, including misselling, money laundering and even pollution, as they finance some of the biggest production companies of the world.

However, the big picture is not the only obstacle a typical customer has to overcome while facing with his bank. Poor customer experiences and very limited social responsibility combined with increasing – and not fulfilled – needs for new technologies create a rather unfavorable image of the entire industry. But why is it the case in the first place?

New banking, new challenges

The financial crisis of 2008 combined with recent pandemic caused massive reputational damage to the financial services industry. Therefore, it does not come as a surprise that customers’ preferences have changed as a result of those events. Now, they expect banks not only to provide them with basic financial services, but also:

- Protect customers against wrong products, unsolicited advisory, and scams, regardless of the regulations that are already in place.

- Be transparent on both local and international markets.

- Support sustainability and social responsibility efforts in a clearly visible way.

- Safeguard financial stability in the face of new challenges, including climate change and potential future crisis.

As it can be seen, the range of needs is wide and diverse, and so should be the banks’ answer to those issues. However, it seems obvious that adjusting to the new reality proved to be a challenge for many financial institutions.

Modern banking: not a changing landscape

There’s no denying that the world of banking is rapidly changing. Digitization, increasing importance of CX or growing need for IT processes are the phenomena shaping the industry. Still, it has proven to be a material that is very hard to mold.

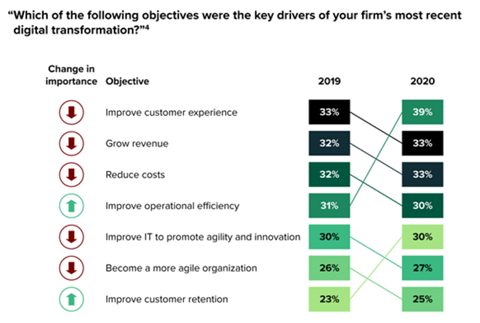

According to the report “Forrester Infographic: The State Of Digital Transformation In Financial Services, 2021” authored by Oliwia Berdak and Luis Deya of Forrester Research, while banks are trying to keep up with the digital transformation, some of their drivers and activities have changed as a result of the pandemic. In a post-pandemic reality, they focused more on the revenues and operational efficiency, and less on improving IT.

- Low interest in improving customer experience, despite growing need for its implementation.

- Providing customers with poor or average experiences2.

- Underestimation of organizational challenges in digital transformation strategies3.

Those problems can be seen across the entire industry – and they are the root of all the evil that is currently associated with banks. However, that does not mean that the situation cannot change. Fortunately, our experts can provide you with insights on how to do that.

Experience vs performance: can banks benefit from changing approach?

For many CEOs, meeting customers’ expectations is not always the best thing to do from a bank’s perspective. This is, however, not the case. Modern technologies combined with a more customer-driven approach can lead to improved satisfaction rates, as well as growing revenues. How?

Empowering customers is one action that can be used as an example. It can be done with chat, voice calls and video calls, as well as other innovative tools such as AI implemented in bank’s own infrastructure. Those solutions can efficiently allocate human resources, reduce waiting time and improve overall satisfaction, resulting in better customer retention and greater revenues. Should the technology be combined with Cloud, customers can become masters of their own finances thanks to reliable and accessible communication channels.

Another example of this can be using customer experience to bank’s advantage. Implementing UX/UI practices combined with customer research can simplify the use of mobile and desktop applications. As a result, customer can manage his finances on his own, reducing the cost of staff that otherwise would be needed to solve his problems.

Sustainability explained

Those are, however, one of many uses of sustainability and modern technologies in banking processes. We believe that there is much more to offer – and we can prove it while giving you a better insight into the field… What is more, we did that with a person responsible for gathering all the data we mentioned in the article – Oliwia Berdak, VP, Research Director, Forrester Research.

We strongly encourage you to watch our webinar “Build your Spaceship to reach the cloud in Corporate Banking” featuring guest speaker Oliwia Berdak that shed some more light on the matters we discussed in this article – and many more. The video is available on demand here:

We know all the problems and challenges that banks and financial institutions are currently facing. Our offer includes all mentioned technologies and solutions that help to solve them.

To learn more visit also:

AI Banking – Digital banking and intelligent automation

UXLab – Awarded UX solutions

LiveBank – Virtual Bank Branch

Resources:

- Forrester Research, Oliwia Berdak, Luis Deya, “Financial Services Firms Can Earn Trust With A Real Commitment To Sustainability”, https://www.forrester.com/blogs/financial-services-firms-can-earn-trust-with-a-real-commitment-to-sustainability/

- Forrester Research, Oliwia Berdak, Clarissa Skinner, “How European Banks Can Improve Their Customer Experience: Best Practices From The Top CX Index Scorers Across Europe”, https://www.forrester.com/report/how-european-banks-can-improve-their-customer-experience/RES175974

- Forrester Research, Oliwia Berdak, Luis Deya, “Forrester Infographic: The State Of Digital Transformation In Financial Services, 2021”, https://www.forrester.com/report/forrester-infographic-the-state-of-digital-transformation-in-financial-services/RES165820

Polski

Polski

Deutsch

Deutsch