General Overview

SGB Bank is a cooperative bank that was looking for a way to create and enhance its digital experiences with new technologies tailored to the needs of the customers. As the affiliating bank for almost 200 associated cooperative banks it was seeking efficient solutions that can be implemented in just a few months and available to all the entities of SGB Group. Digital transformation has accelerated by COVID-19 pandemic, a factor that occurred during the project.

To solve its most pressing problems, SGB Bank begun a cooperation with Ailleron, aiming to improve performance and adjust to a dynamically changing market.

The Customer

SGB Group is one of the two cooperative banks associations in Poland. It consists of:

- ~200 cooperative banks

- ~1500 banking outlets

- ~4000 ATMs

- ~12000 employees.

SGB Bank provides its services to both individual and corporate customers, as well as companies from agricultural industry.

Currently, SGB Bank focuses on the development of its digital banking, including mobile application, mobile payments (BLIK, Google Pay, Apple Pay and others) and online banking. According to the bank, the aim of this strategy is to put customers’ needs first and provide him with safe and reliable solutions of the future.

IT Systems in SGB Bank

The cooperative banks associated in SGB Group had various core banking systems provided by 3 independent vendors. Additionally, they were also using a few independent digital banking solutions delivered by different software houses.

In 2019 PSD2 implementation provided an opportunity to introduce a unified interface access to all the banks, members of the SGB Group. Therefore, it was then decided to extend the scope of services designed by SGB HUB. The development was to be used for digital transformation while developing various central projects, including SGB Mobile Banking

Challenges

Implementation: 6 months from the start to MMP Go-Live!

The main idea behind designing the application functionalities was to fulfil basic transactional needs of banking clients and allow day-to-day banking operations. The remaining features were scheduled to be released in the following months according to SGB’s business strategy milestones.

It took 6 months to develop & deliver Minimum Marketable Product that was tested by 2000 bank employees during Friends and Family phase and then in July offered to real customers.

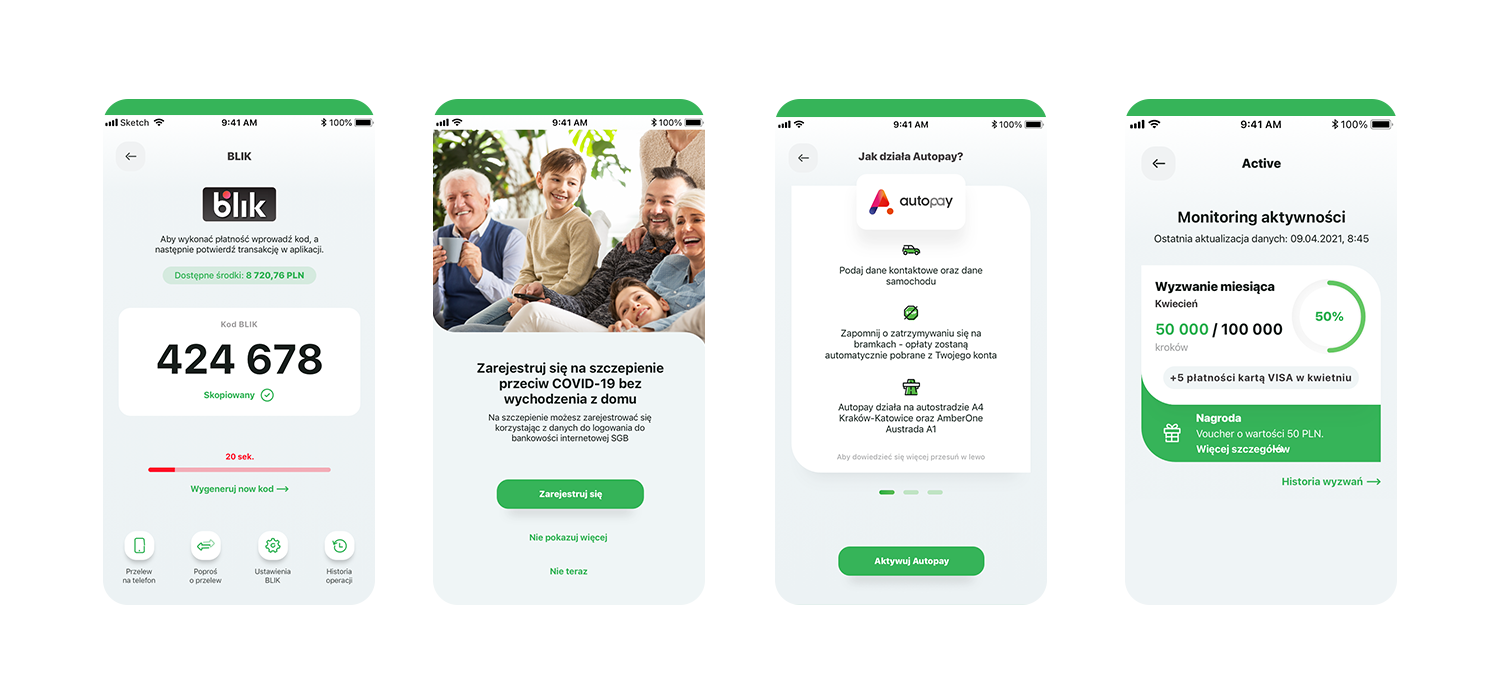

The application delivered in May 2020 has provided SGB Group clients with access to personal accounts, saving accounts, FX Accounts, debit and credit cards. The design of the application has been a result of a close co-operation of the UX/UI Ailleron experts with SGB Bank representatives. It was organized using the Design Sprint methodology and has been proven effective with tests of prototypes performed with end users.

The application also included a set of features allowing clients to have a better control over their payment cards. Those include:

- Activating payment card

- Setting online transaction limits

- Requesting instantaneous cards restriction

- Temporary blocking/unblocking.

Users could also monitor the e-wallets containing their card details and manage them effectively.

Implementation: rapid evolution after the launch

Between July 2020 and September 2021, SGB Bank & Ailleron common team entered the next project stage. The mobile application has been further upgraded with a number of functionalities.

Those include among others:

- online debit card issuing

- 3D Secure authorizations

- COVID-19 module

- eKYC process for opening a Mobile Account,

- Mobile Authorization for Internet Banking in the banks with Novum core banking system (majority of the banks in the group),

- Active Challenges module (Garmin Connect integration),

- Autopay (automatic payments for highways and parking lots),

- BLIK – instantaneous transfers to mobile phone numbers.

The set of planned features is in the pipeline in various development stages.

Ailleron also delivered a product called Campaign & Notification Manager. It enables authorized employee to manage mobile push campaigns and mobile push & SMS notifications templates. The feature was expanded with the option of managing in-app splash screens and banners. Therefore, it provides a comprehensive communication channel for marketing content.

List of SGB Mobile application major functionalities provided by Ailleron throughout the project with SGB Bank

- Mobile banking applications for iOS and Android

- access to current, FX and saving accounts (transactions history, internal and domestic transfers)

- activate and use BLIK (Polish Mobile Payments standard)

- payment cards management (transactions history, activation, limits management, cards restriction/temporary blocking/unblocking)

- E2E digital and self service activation using PSD2 extended interface

- eKYC and online mobile account opening

- mobile authorisation – for operations performed in Internet Banking in ca 100 cooperative banks

- 3D Secure authorization

- Online Debit Card issuing

- Google Pay / Apple Pay in app provisioning

- Active Challenges module – integrated with Garmin Connect

- supporting physical activities in post pandemic times

- Autopay – automatic payments for highways, car washes and parking lots

- BLIK payments and P2P instantaneous transfers to mobile phone number

- Authorization Server

- Subscription Manager

- Back office module for bank employees

- Parametrization of major functionalities per cooperative bank

- Campaign & Notification Manager

Let’s make financial experiences

easy and enjoyable together!

Tell us what you need and we will contact you shortly.

Polski

Polski Deutsch

Deutsch