In today’s data-driven world, financial institutions collect cosmic amounts of information to enhance customer experience and streamline transactions. The financial industry requires appropriate tools to tackle new IT and business challenges. This article will explore the characteristics and functionalities of Customer Data Platforms and Data Warehouses, highlighting their unique strengths and use cases.

Table of Contents

- What is the purpose of collecting #data in your organization?

- Customer Data Platform vs. Data Warehouse: understanding the differences

- Successful landing with the flexible and data-driven approach in the Ailleron Customer Data Platform

- Data Warehouses as a valuable asset in data management strategy

- Make the most of your data for competitive advantage

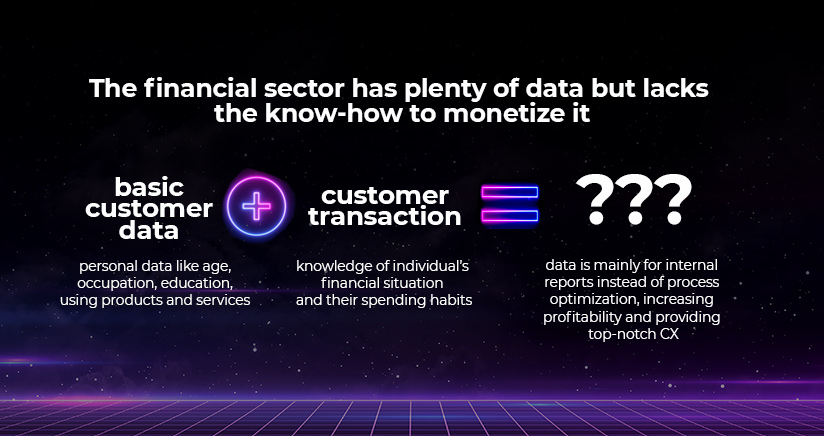

What is the purpose of collecting #data in your organization?

Data distribution and integration is challenging in every organization, but it could be even more complicated with outdated internal IT systems and many different types of data. However, with a flexible approach to data collection and a 360-degree view of the customer, it will be an inspiring and thrilling mission.;) Customer Data Platform (CDP) and Data Warehouse (DWH) are 2 prominent models in the data management domain. While both are crucial for data storage and analysis tools, they serve distinct purposes. How to choose between them and implement the most cost-effective and innovative option for your organization? First, think why and then smoothly pass to how. Determine if you want to use real-time data extensively, which will constantly work for your revenue and top-notch personalized experience (CDP), or you would need statistical reports from structured data or internal inputs instead (DWH). When it comes to the cost of these systems, it is common to implement just one. But it’s worth bearing in mind that you don’t have to choose between data at rest (DWH) and data in motion (CDP)… CDP processes data in real-time, enabling immediate personalization and timely customer engagement. DWH typically operates on batch processing, providing deep insights based on historical data. Therefore, the CDP and DWH combination may be preferred for organizations with advanced data expectations and specific business requirements.

Customer Data Platform vs. Data Warehouse: understanding the differences

Although topics regarding data have been buzzing around more and more for many months, a data warehouse is not a new concept in the world of data. Different kinds of DWHs are a must-have for enterprise companies and financial institutions and have been there for years. They differ from customer data platforms, although they were intended to work closely with the CDPs for the best data performance. So, what are the unique strengths and use cases for both solutions? Data Warehouse is a central repository of information that can be analyzed to make better strategic decisions. It also collects processed data in batches from various internal systems, relational databases, and other sources. This solution makes data accessible through application reports, dashboards and analytics queries. It’s dedicated to IT departments (Solutions Architects and IT Managers) managing data silos, like distant and large constellations. 😉 It’s great support for long-term historical data analysis with structured data and strict rules of access control. But when we look deeper, this solution development could be too expensive, especially when the volume of data increases and has limited flexibility. Finally, it doesn’t collect behavioral data and has slow query performance, being unsuited to our ever-evolving digital world. Fortunately, Customer Data Platform comes to the rescue, bringing many agile answers for today’s challenges. CDP provides better access to data for C-level decision-makers, Product Managers/Owners and provides real-time customer data with high performance, scalability and cost-effectiveness. From a business perspective, CDP gives you faster data activation for better data-driven personalization across channels and fewer engineering hours spent on adding new data sources. Thus, it enables business and marketing departments to create a single 360-degree customer view with data visualization. Accessing a continuous stream of high-quality customer data from all online and offline customer touchpoints (such as mobile apps and websites, social media, or the data warehouse) makes understanding your customer journey and expectations easier. CDP also has convenient features for IT departments like:

- event-driven solution collecting customer data from various internal and external sources in real-time;

- streaming data to external tools and making them available on demand;

- storing structured, semi-structured and unstructured data;

- storing raw and enhanced (transformed data).

All of this happens thanks to unique CDP architecture, with Data Ingestion, Data Streaming & Transformation, Data Lakes (Raw and Enhanced), Operational Data Stores (ODS), API Gateway, Graph QL and Data Governance.  Most importantly, CDP lets you use all this data-based knowledge smoothly in real-time for enhanced customer service, data-driven and effective marketing campaigns, or create new revenue streams and drive sales. Sounds perfect, but you must know how to navigate this powerful spaceship. 😉 Before grabbing the steering wheel, consider the risk of poor quality of raw data, broader access to data in your organization, and the necessity to engage many departments in the CDP implementation process. On the other hand, DWH may suffice if your company has several defined ways a customer interacts with your business and needs to accommodate a broader range of structured and organized data, such as sales, inventory, financial, and operational data. However, by expanding your businesses, you will likely invest in a next-generation customer data platform strategy sooner or later. In conclusion, think about the role of customer data management in your organization. Do you need to provide data-driven insights for your organization in a self-service and dynamic model? CDPs will provide data access to other systems and business departments. In our solution, the Ailleron Customer Data Platform (ACDP), data is available and searchable, eliminating the need for engineers to extract, transform and load it from one system to another.

Most importantly, CDP lets you use all this data-based knowledge smoothly in real-time for enhanced customer service, data-driven and effective marketing campaigns, or create new revenue streams and drive sales. Sounds perfect, but you must know how to navigate this powerful spaceship. 😉 Before grabbing the steering wheel, consider the risk of poor quality of raw data, broader access to data in your organization, and the necessity to engage many departments in the CDP implementation process. On the other hand, DWH may suffice if your company has several defined ways a customer interacts with your business and needs to accommodate a broader range of structured and organized data, such as sales, inventory, financial, and operational data. However, by expanding your businesses, you will likely invest in a next-generation customer data platform strategy sooner or later. In conclusion, think about the role of customer data management in your organization. Do you need to provide data-driven insights for your organization in a self-service and dynamic model? CDPs will provide data access to other systems and business departments. In our solution, the Ailleron Customer Data Platform (ACDP), data is available and searchable, eliminating the need for engineers to extract, transform and load it from one system to another.

Successful landing with the flexible and data-driven approach in the Ailleron Customer Data Platform

After comparing CDPs’ and DWHs’ pros and cons, we may have one common conclusion – CDPs seem to address current data challenges better, faster and more effectively. It could bring much more satisfaction and real value for the whole organization, and it isn’t only for technological forerunners. Connecting all constellations from the big data world and creating democratization of data helps make sound choices for everyone.

How to choose the right solution, and why should it be mainly CDP?

From the business perspective, we can recognize repetitive challenges like high demand for real-time data, long time to market in preparing data views and new types of data gathered. On the contrary, IT departments face challenges like new data sources (or not integrated with DWHs), increased data volumes and high costs of infrastructure. Which key factors should be taken into consideration? It depends. From the company size, the business profile of your activities, the outcome you want to achieve and many more. However, we advise 4 essential factors helping in your decision such as:

- type of data to be stored and analyzed,

- data volume and data quality to be sent to your data funnel,

- performance in terms of access to data and expectations about upfront and ongoing costs,

- different expectations for data use – if they are well-defined/well-known, or if you need a flexible approach.

Finally, think about the ever-evolving digital landscape of your business and your ability to react in the future. When you decide on CDP, check if your platform has all listed below, like the Ailleron Customer Data Platform (ACDP).

- Single Customer View capturing customer behavior, such as their purchasing frequency, preferred shopping times, and online interaction patterns and triggers.

- Target Audience Building enabling marketing teams to send their campaign via their preferred communication channel at the time of day each person is most likely to respond.

- Predictive Models with ML technology enabling business to forecast a campaign’s success by analyzing prior customer interactions.

- First-Party Data Management giving you information about your customers no third party can purchase.

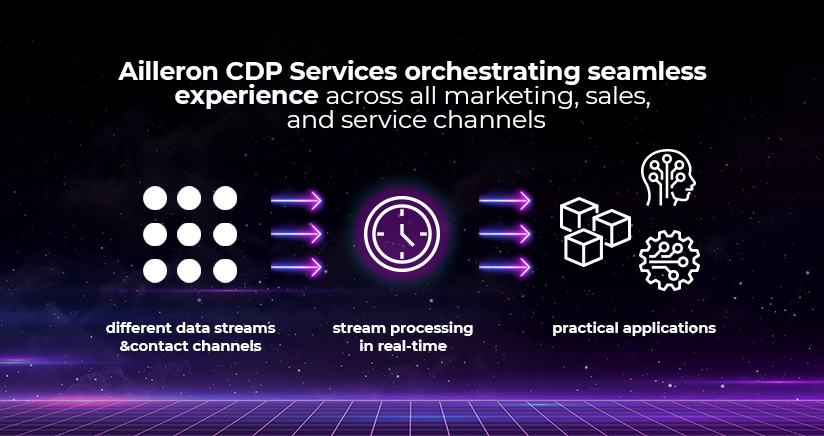

Architecture and outcome from CDP for data monetization

CDP’s architecture is quite a fascinating data environment, so it’s worth taking a closer look at it. First of all, it’s event-driven architecture, which feeds our data funnel with historical data once and doesn’t have to be updated anymore because events are distributed to subsequent events. Then, we have data streaming or data lakes, which are structured and unstructured data. We fill them with the maximum amount of data and “improve” them, i.e., give them value and the status of business insights, by optimizing and changing their format to be compatible with our system. All these processes are supported by data analytics and visualization, ending with operational data stores like graph QL or some lists or tables. The engine for using all these data effectively is the customer platform as a streaming element, like Kafka or API gateway. This structure aim is to make cooperation with different data components easy, fast and endless. In our case, the Ailleron Customer Data Platform (ACDP) is a next-generation data platform created and developed in real-time thanks to an inspirational partnership with Mongo DB. Hence, the outcome of ACDP’s performance is diverse and enriches the whole organization. It could be an innovative data hub, easily accessible to both technical and non-technical professionals. Our ACDP enables enterprises to become more responsive and insightful by sharing and monetizing data without copying or moving it. Additionally, it allows data scientists, engineers, and application developers to extract value from the data in ways that are not possible with existing solutions such as Data Warehouse and legacy Data Lakes. The benefits of using ACDP include:

- data analysis and segmentation processed using machine learning for categorization, segmentation, product recommendations, recurring transactions, transaction classification, and anomaly detection;

- proactive offer and recommendation in real-time and improved decision-making;

- hyper-personalized data provided for internal use for CRM or reporting systems;

- adhering to rules on compliance and privacy.

Choose the delivery model to fit ACDP to your needs

When you delve deeper into our financial technology services, very high flexibility is one of our unique value propositions. That’s why we can adapt the delivery model to fit ACDP to the customer’s capabilities and situation. And from that point, CDP is a technically easy topic. The first cooperation model with Ailleron is – Out-of-the-shelf Technology Stack. In this approach, we can build the platform with Ailleron’s recommended components of choice like MongoDB Data Lake, MongoDB Operational Data Stores with domain data, Data Streaming solutions, GraphQL, Data Hub, API Gateway, and many more by creating the data hub to secure your success. The second model will maximize the potential of the existing IT architecture by creating – Customer Technology Stack. As long as you prefer your organizational stack and upgrade it with Ailleron components, you will have it with superb #AilleronExperts expertise in the package. The Bespoke Customer Data Platform is our third model of cooperation. It’s the option that gives the most opportunities for both sides. We can design and deliver a perfect-fit solution in line with your Enterprise Architecture requirements. Think twice about the best option for you. If you hesitate or wonder what’s the most popular implementation way on the financial market, take a practical hint from Michał Walerowski, our Business Unit Director AI/ML & Data Solutions.

– Many of our customers already have a system architecture that can be utilized to some degree. If using these components is suitable for the final solution’s performance, it’s recommended. This approach offers financial optimization by using readily available components and allows for flexibility to meet the financial institution’s unique needs.-

Data Warehouses as a valuable asset in data management strategy

Although Ailleron specializes in CDPs, we notice DWHs also as an important tool for working with data in a financial organization. These two solutions, used in sync, can access all real-time data you need when it is needed. They can interact and support each other, creating innovative and functional data hub without duplicating costs. So, how CDPs and DWHs can work together? DWHs can solve enterprise data challenges by supporting non-customer analytics and being the record system for enterprise and data stores. And then it could also perform as a CDP essential part. Currently, DWHs are great repositories for data in the whole spectrum, and CDPs are a tool for business users to access and activate that data in creating customer experiences. Using both could boost perfect cooperation between business and IT, especially from the business perspective. Imagine you don’t have to bother IT departments with every new use case and can smoothly enhance customer experiences across all touchpoints or omnichannel journeys across the entire customer lifecycle. The rule of thumb in the most innovative organization is to send deep customer profile and transaction data from DWHs to CDPs. It gives greater precision and accuracy when performing enterprise-wide analysis in an ever-evolving data world.

Make the most of your data for competitive advantage

To create a well-thought-out innovative data management strategy and gain a competitive advantage in the financial market, you must understand the current state of play. Essentially, many tools enable storing various data types, but you must combine different technologies and utilize your data to exceed clients’ expectations. CDPs take the data from DWHs, but the magic for everyone (c-levels, business, and IT departments) comes from CDPs, like the Ailleron Customer Data Platform. The ACDP can solve customer data challenges and provide data-driven insights, but implementing CDP requires involvement from each department. Data management must be seen as a process with cycles of feedback and implementation between your teams and your CDP vendor. Learn more about our ACDP features and contact our #AilleronExperts to turn big data into value. The right tool and expert insights will help you cut through the noise to spot trends, risks and opportunities by creating next-generation CDP strategies. Think about CDP like your agile spaceship in a huge cosmic space with different DWHs and hop on our board. 😉

Author’s note: This article was created thanks to the close cooperation with Ailleron Business Unit – AI/ML & Data Solutions and substantive materials provided by our #AilleronExperts.

Polski

Polski

Deutsch

Deutsch