Keep your business ongoing, stay compliant and prevent frauds from happening without engaging your employees.

The eKYC (electronic Know Your Customer) process enables financial services to verify a customer’s identity fully remotely with automated decision-making algorithms.

Ailleron eKYC allows for bank-grade secure and eIDAS compliant customer onboarding, authentication and contracting processes of a remote individual’s identity verification with multiple fraud prevention techniques. AI-powered identity verification technology delivers accurate results in near real-time and helps in:

- onboarding of new customers

- signing a contract with electronic signature

- updating data of existing customer

- make periodical information checks.

Ailleron eKYC can be also used as a part of multifactor customer authentication.

Online decisions safer than ever

For years, online transactions and operations were prone to fraud and identity theft. The latest eKYC technology can make this more secure and properly address customers’ concerns.

Advanced algorithms combined with AI-based video ID verification and an option to read RFID chips in modern ID documents create a powerful KYC verification tool that your institution can rely on.

Customer-friendly procedure

eKYC does not require any specialized devices. The only thing your customer needs to verify his or her identity is a smartphone with a camera that our eKYC uses to perform AI-based video ID verification. The entire process is available 24/7 – no branches, no queues and no waiting.

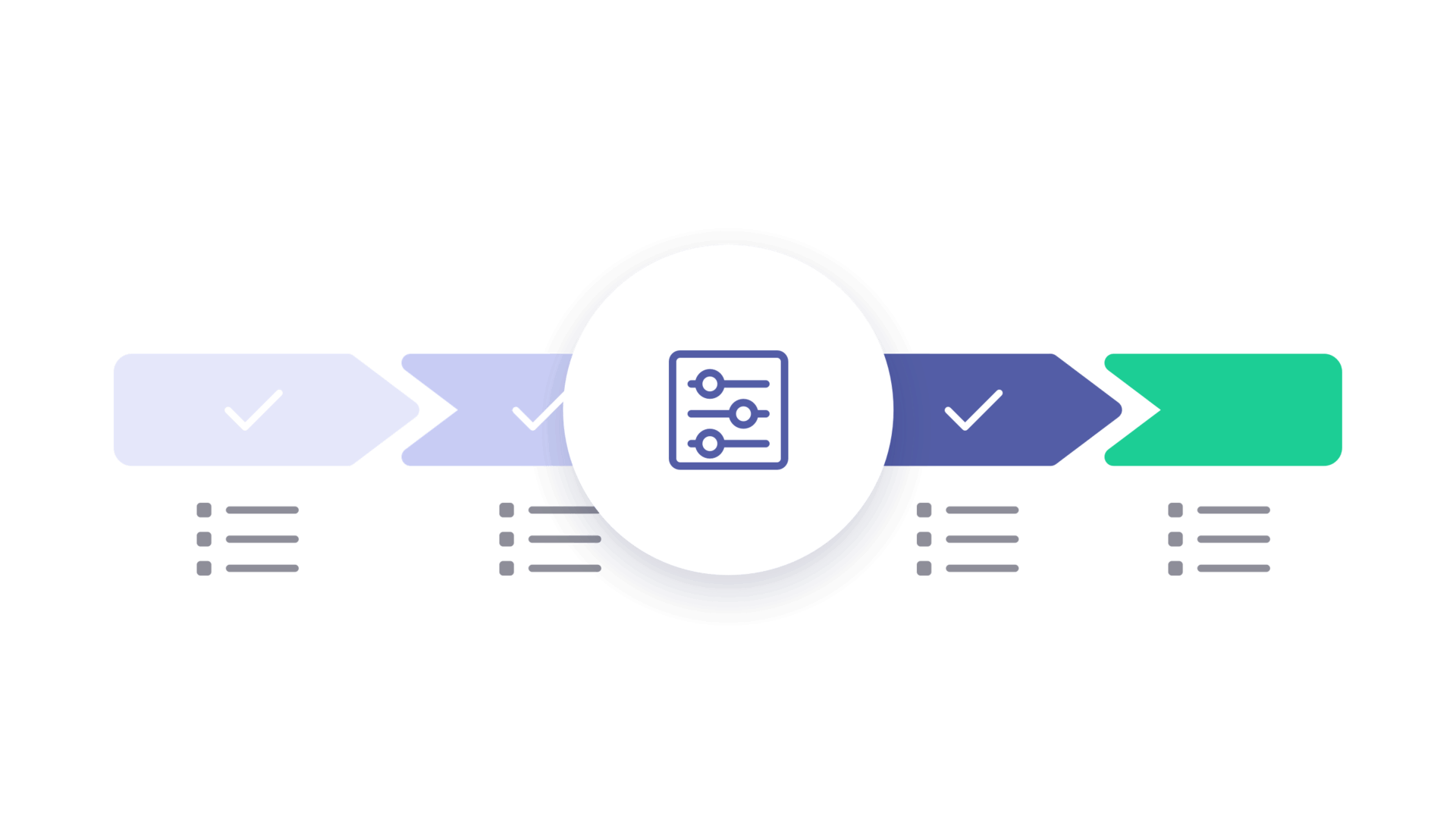

Modular & configurable identity verification process

The financial institution manages the order of the steps according to their customer’s journey.

Advanced technologies

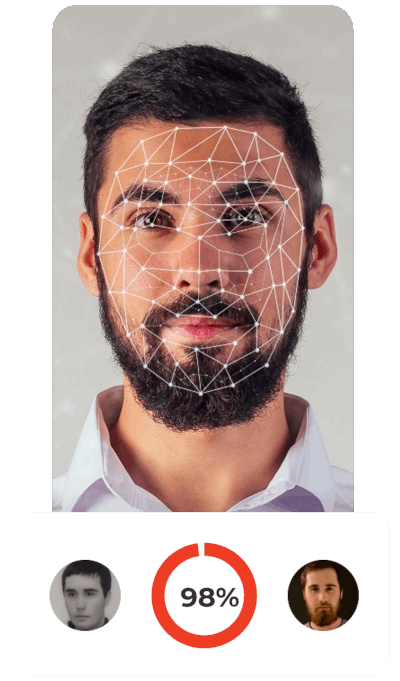

Our eKYC module was built based on the latest technologies compliant with banking security standards. It includes IDENTT biometrics based on high-capacity machine learning engines with neural networks. In addition, there’s the option to read RFID chips in modern ID documents and to use autonomous decision engine. AI algorithms are already trained on over 5 million European customer faces.

Multiple applications

The eKYC procedure can be used for various purposes, such as onboarding of new customers, sales processes, customer data update for periodical checks and multifactor customer authentication. Your institution decides which one it needs to use at any given moment!

Improved process efficiency

Are your advisors flooded with additional tasks? Not anymore. Advanced automated modules in eKYC allow customers to complete processes without human support, reducing time of service, margin of error and the costs of every operation.

Quick document signature

Ailleron eKYC can be equipped with our Cryptographic Authentication Server to speed up document signature process to even less than 10 seconds just with 3 taps on the screen. This significantly increases the conversion rate in sales compared to other options (i.e. document delivery by a courier or in branch).

Link to external and internal AML databases

Our eKYC solution is connected with relevant international sanctions lists, PEP lists and the Lost and Stolen documents database. Integrations with additional external and internal databases used by a financial institution in AML and risk detection processes are also possible. In addition, eKYC can be equipped with a forbidden face module that can detect false IDs with faces used in forged documents or the same face used with different identity data.

International coverage

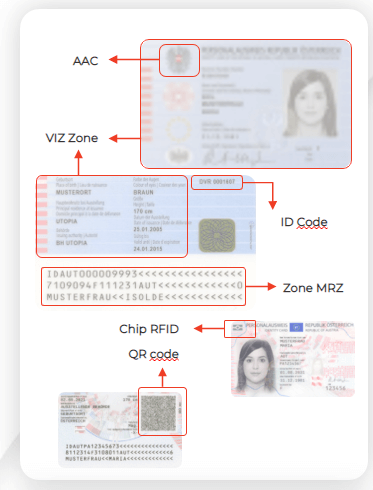

eKYC is trained to verify the validity and genuineness of all existing generations of ID documents (ID cards, passports and driver’s licenses) that are currently in use in Europe, North America, the LATAM region and selected APAC and African countries. It recognizes characters in Latin, Cyrillic and Greek. It is capable of reading OCR zone, MRZ, both 2D, QR codes and data from RFID chips e.g. those implemented in new EU IDs. Therefore, you can apply our solution in almost any location, improving your services and reducing costs.

User-friendly back-office

Your employees will appreciate eKYC as much as your customers. Apart from reducing the amount of work to be done, eKYC also offers a back-office application with rich, no-code parametrization options and details of all checkpoints per verification session, allowing advisors or auditors to verify doubtful cases or confirm system decisions when necessary.

Approved by financial institutions

and compliant with eIDAS.

Ailleron eKYC is powered by the IDENTT engine, which is responsible for:

- facial biometrics

- liveness checks

- document OCR and RFID data extraction

- document verification

IDENTT is a Hamburg-based digital authentication company with more than 20 years of experience in document and bank note verification services. IDENTT Knowledge® is a database of security features for ID documents & banknotes used in 194 countries. The company’s services are based on high-capacity machine learning engines with neural networks that use real-time identity fraud risk scores and data curation strategies.

The IDENTT solution engine is already present in 10 European banks and leasing companies throughout the EU, with 5 million verification sessions having been processed at the end of 2021.

Do not leave your customers on their own in a world full of fraud and threats. Begin your journey with eKYC now and prevent security breaches from happening.

Contact us now and see how eKYC could benefit the growth of your organization.

Grzegorz Mika

General Manager Financial Technology Services

Polski

Polski Deutsch

Deutsch