In recent years, the banking sector has undergone a profound transformation. The growth of online and mobile banking, contactless payments, and instant transfers has moved daily financial operations increasingly into the digital world. At the same time, declining foot traffic in physical branches raises a question: will bank branches disappear, or will they evolve into a new form of holistic financial services?

Table of Contents

- Will Online Banking Take Over Traditional Branches?

- Trends in the Polish Banking Sector: Automation and Self-Service

- New Branch Formats in the Digital Era

- The Branches of the Future: Experiences, Education, and Inclusivity

- The Evolution of Financial Services

- References

Will Online Banking Take Over Traditional Branches?

In many countries, both in Europe and the United States, there is a clear trend toward reducing the number of physical branches. Banks cite high operational costs as the main reason: maintaining premises, cash handling, and staff employment are significantly more expensive than running digital channels. Additionally, customer interest in visiting branches has declined, as most services can now be performed faster and more conveniently via mobile apps or online platforms. Automation also plays a key role: ATMs, deposit machines, and increasingly virtual assistants are taking over tasks previously handled by bank staff.

Data from the European Central Bank clearly shows that the number of branches in the European Union is steadily decreasing, with the process accelerating significantly after the COVID-19 pandemic. However, this does not mean that all branches will disappear soon. Their role is changing, yet they remain essential, and the impact of technology on branches is intriguing. In Poland, 51% of customers still visit a branch at least once per quarter (Kearney, 2023). Furthermore, 61% of customers still prefer direct contact with an advisor for financial education matters (Accenture, 2025).

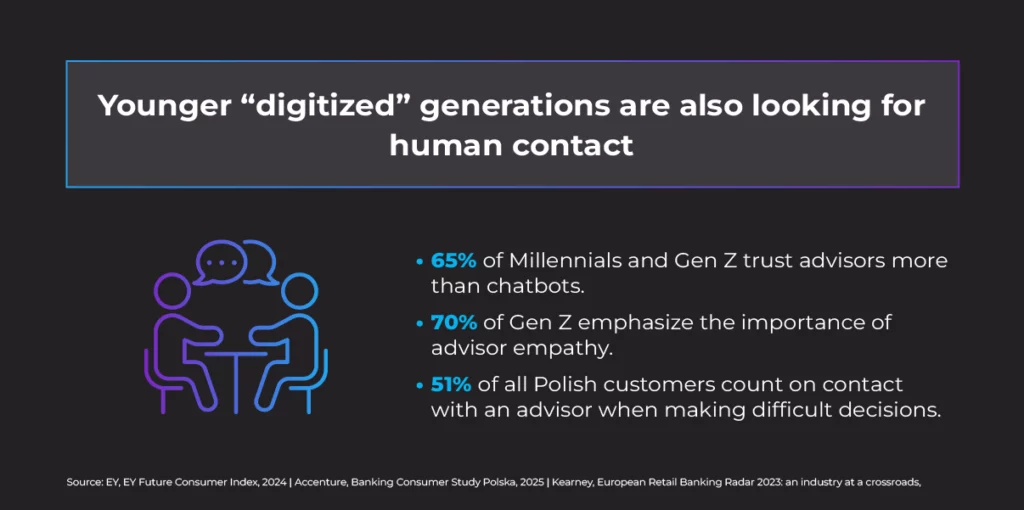

Contrary to stereotypes, younger generations also see value in face-to-face interactions. Millennials and Generation Z expect personalized advice and authenticity, which are harder to achieve online. Moreover, they often make financial decisions together with their parents, creating a need for spaces for discussion within branches. Nearly 65% of Generation Z consumers still prefer human customer service when dealing with complex issues. At the same time, in the face of rising cyber threats such as phishing or fake banking apps, physical branches symbolize security and reliability for many customers.

Trends in the Polish Banking Sector: Automation and Self-Service

Polish banks are rapidly adapting to changing perceptions of modern banking and are experimenting with new branch models. mBank has developed two types of branches: light points in shopping centers, offering quick services and modern technologies, and advisory centers for longer client meetings. Santander combines branches with coworking spaces and cafes under the “Work Cafe” concept, creating friendly and multifunctional spaces.

Modern branches indicate a clear trend: banks want to transform their branches into spaces adapted to the diverse needs of customers—open and multifunctional. Light points address immediate needs, advisory centers provide personalized support, and Work Cafes emphasize experience and the integration of banking with everyday social life. It signals that the future of branches will not focus on reducing their number, but on redesigning their function and role in the banking ecosystem.

Rethinking Branch Formats in the Digital Era

Transforming bank branches does not mean a return to traditional teller counters and queues. Self-service technologies—such as ATMs, next-generation deposit machines, and interactive kiosks—play a key role, taking over repetitive and routine tasks. They allow customers to perform basic operations efficiently and quickly, from cash deposits and withdrawals to printing documents, submitting applications, or updating information, without waiting for an advisor.

Other industries inspire, demonstrating the efficiency gains of automation. McDonald’s, by implementing touch-screen ordering kiosks, reduced service time by up to 40% during peak hours while increasing the average order value by 20–30%, as customers are more likely to add extras when controlling the purchase process. IKEA offers Upptäcka kiosks in its stores, enabling customers to search for products and plan purchases independently. This reduces service time per customer and frees staff for more complex tasks. Even in the convenience sector, as in Żabka, self-service checkouts contributed to a 20% sales increase and improved customer satisfaction. This shows that self-service technology not only streamlines processes but also supports business growth.

The Branches of the Future—Experiences, Education, and Inclusivity

Polish banking can effectively leverage these experiences and adapt them to local needs. Interactive kiosks in branches can handle not only basic transactions but also onboarding processes. Services such as account opening, document printing, joining loyalty programs, or quickly signing agreements via e-signature gain new value when combined with remote identity verification and online client identification. Adding instant video connection with an advisor, as in LiveBank, creates a service that combines autonomy with human support. For users, this means convenience, time savings, and greater flexibility.

Features such as eKYC (online onboarding and document verification), e-signature, identity confirmation, and real-time contact via video, audio, or chat simplify formalities and build trust. Branches can become hubs of intelligent automation. Technology removes barriers, and clients can handle matters remotely while having the assurance that advisor support is always available if needed.

Financial advisors also benefit, gaining more satisfaction by focusing on what matters most—building relationships, advising, and supporting clients in achieving long-term goals and financial well-being.

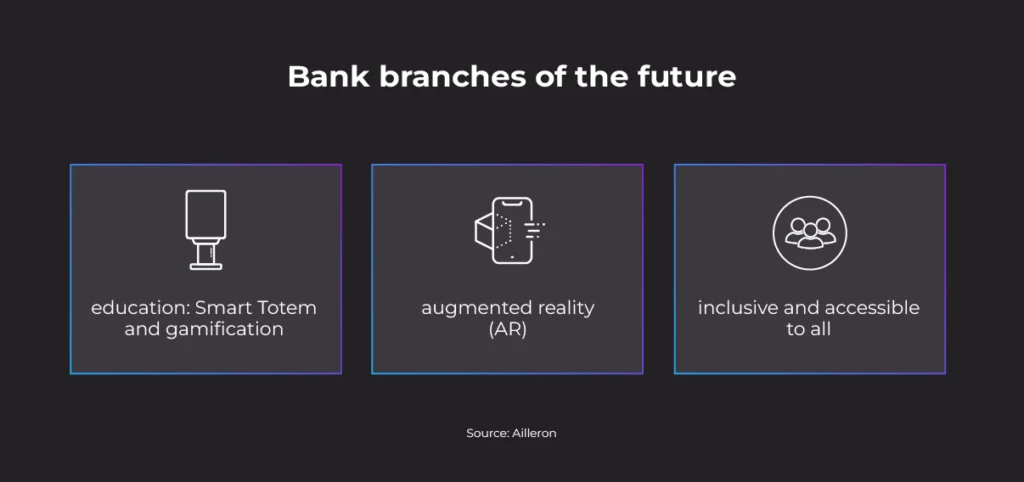

Future branches could be designed not only as product service points but also as financial experience centers, where clients spend time in engaging and inspiring ways. In interactive educational spaces, both young people and adults could learn basic budgeting, investing, and digital security through quizzes, short videos, or financial simulations. In “60-second education” zones, clients could watch interactive mini-lessons and receive personalized reports with summaries and product recommendations.

Future branches could also host new digital products, such as Smart Totems—interactive advisors available 24/7 that recognize clients (via mobile app or QR code) and suggest personalized financial scenarios. This would allow quick document signing, video calls with advisors, or gamification—for example, “Build Your Household Budget.” Engaged clients earn points based on financial decisions and learn which products can help achieve their goals.

Branches could also include augmented reality (AR) zones. Clients select a goal—buying a home, funding a child’s education, or retirement—and the system visualizes it on a screen, showing how much to save each month, how costs change with inflation, and which financial scenarios can accelerate achieving the goal. This is not only educational but also an emotional experience that strengthens motivation to save and invest.

Modern branches should also be inclusive and accessible to all. Solutions could support people with different needs, such as 3D avatars using sign language, voice assistants for the visually impaired, and devices adapted to wheelchair users’ height. Offering interface language selection at start screens would make the branch more accessible to foreigners. A simplified service mode for seniors, with large fonts and intuitive messages, should also be available.

Such solutions make traditional branches open and safe for everyone, regardless of age, physical condition, or digital experience. Future branches may become multifunctional hubs where education, technology, advisory services, and inclusivity converge, making a visit a valuable and enjoyable experience. This shifts the perception of a branch from a transactional point to a social role—centers of education, integration, and financial support.

The Evolution of Financial Services

Bank branches in Poland will not disappear but will undergo a significant transformation. The traditional teller-based model will gradually give way to self-service and automation, while branches become spaces for advisory services, education, and customer experience building. The future of Polish physical banking lies in hybrid branches—combining modern technology, meeting spaces, and personalized advisory.

Globally, the banking ecosystem is entering a period full of new opportunities and innovations. With rapidly evolving technology, AI, bold decision-making, and the support of the right partner in processes and tech, the sky is the limit. This evolution does not necessarily mean mass branch closures but rather a revaluation of their roles and functions. Similarly, the role of financial advisors is shifting toward professionals who have the space and time to focus on individual financial well-being and strategic wealth management.

Do You Need Help Keeping Up with Upcoming Changes in Banking Infrastructure?

Contact our UXLab Team!FAQ

References

- Kearney. European Retail Banking Radar 2023: An Industry at a Crossroads. 2023.

- Accenture. Banking Consumer Study Poland. 2025.

- European Central Bank. The Changing Landscape of Bank Offices in the Euro Area. Available online: ECB blog

- Business Wire. Gen Z Wants Brands to Level Up Their AI Customer Service Game. Available online: Business Wire

- Touch Screen Kiosk Review. How McDonald’s Touch Screen Kiosks Reduce Wait Times and Increase Efficiency. Available online: Touch Screen Kiosk Review

- Ingka Group (IKEA). How IKEA Upptäcka Self-Service Kiosks Are Transforming the Customer Experience. Available online: Ingka Group

- Żabka Group. Grupa Żabka po 2024 r.: Preliminary Sales and Operational Results in Line with Assumptions. Available online: Żabka Group

Polski

Polski Deutsch

Deutsch