Leasing services are about building long-lasting relationships, also in the age of omnipresent digital acceleration and technological arms race. However, when a recent survey shows that as many as 91% of leasing customers experience various difficulties in leasing movable assets, it is worth rethinking the leasing industry’s growth strategy. The ICAN study from April 2023, commissioned by Ailleron, provides plenty of guidance on positioning yourself as a leader in the digital transformation era.

Table of Contents

- The leasing sector in Poland sets off a digital acceleration for the European leasing market

- 5 key developments in the leasing industry according to the ICAN report

- Traditional vs. digital channels

- Digital transactions and digital signature in leasing in 5 years?

- A new opening for the leasing industry – lease-sharing

- Digital acceleration favors the best

The leasing sector in Poland sets off a digital acceleration for the European leasing market

The ICAN “Digital Acceleration in Leasing” report shows leasing customers’ references to using digital tools in the leasing processes. We live in an age where the statement “be uo to date” takes on a very ambitious character. That is why findings like the ones presented in the latest ICAN report are crucial for the entire industry and companies developing innovative technological solutions for leasing services, not only in Poland.

Leasing companies seek to broaden the scope of their offer to attract more customers and meet their growing needs. European leasing market has to face challenges like digitalisation of the leasing sector with modern transactions and sales, barriers in the use of digital signature, self-service in leasing, or lease-sharing platforms. Following the disruptive macroeconomic and social changes connected with COVID-19 or the increasingly widespread use of AI tools such as ChatGPT and Bard, the whole industry needs to focus on the key trends shaping the leasing industry, presented in the ICAN Institute’s report. As was the case during the first debate about the study on eLeasing Day 5.0. conference in Poland, with the participation of Kamil Portka (General Manager LeaseTech Ailleron) and our business partners: Magda Reimann of Santander Leasing and Anna Wisniewska of PKO Leasing. The debate consisted of valuable insights and significant engagement on topics such as the digital comfort zone of leasing customers, their availability and openness to digital signature, and the changing role of leasing advisors.

5 key developments in the leasing industry according to the ICAN report

New technologies are changing the role of advisors and the form of end-client support in all sectors. However, the leasing sector has been cautious about implementing bold and innovative digital solutions. To better understand these concerns and offer specific solutions at different stages of the leasing process, we commissioned a survey of lessees in Poland – from small companies to medium and large enterprises with different business models.

Independent analysts from ICAN Research, based on a quantitative market survey, 300 interviews, and a desk research on the European trends, highlighted 5 key issues, which are discussed in our ebook “Digital Acceleration in Leasing”. These include a growing interest in digital contact channels, a greater need to digitise leasing transactions and processes, rising expectations of the Customer Platform (including mobile version), and increased demand for lease-sharing platforms.

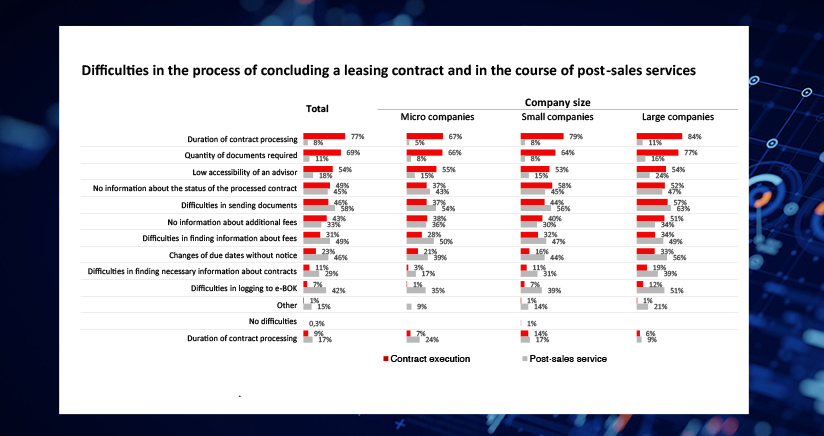

The ICAN Institute report, in the perspective of the next three years, forecasts continued use of leasing, own funds, and credit at similar levels to today. So the industry still has much growth potential but requires rapid and concrete changes. Why? Most respondents encounter difficulties in both the lease-purchase process (91%!) and post-sales processes (83%!). What are the biggest pain points during the execution of leasing transactions? They are still:

- long contract processing time (77%),

- a large number of required documents (69%),

- and low availability of an advisor (54%).

Post-sales processes also need considerable improvement, with the lack of detailed information on fees (58%) and additional costs (49%) and the difficulty in finding information on fees (46%) cited as the most significant drawbacks.

So what will be the market’s response? How should technological leasing services be designed to grasp and anticipate customer and business needs in areas such as sales conversion, customer service and satisfaction, digital signature, security, upselling, and reducing operating costs?

Kamil Portka: “The end of the leasing advisor in the era of hyper-digitalisation? Not yet! Customers clearly indicate that they need one at the negotiation stage. But later on, they prefer to use solutions such as chat, videoconferencing, or mobile apps. Customers want to get their business done in a few clicks.”

Traditional vs. digital channels in the leasing industry

For some time now, comparisons between traditional and digital forms of communication have been becoming rather pale for the former option. The Covid-19 pandemic, ubiquitous remote work, and other significant social changes have irrevocably altered how we interact with customers and business partners. Modern contact forms like videoconferencing, chat, virtual branch and advisor are standard options in many industries. The European leasing market still has much catching up to do, especially in defining the new role of the advisor and opening up to the unique needs of leasing customers and innovative tools, such as the mobile app of the Customer Platform.

Traditional channels still dominate in dealing with leasing advisors: the in-person meeting, email, phone and SMS, and the Customer Platform. However, the ICAN report indicates that over the next three years, the role of new communication channels is expected to increase, and the role of in-person meetings to decline. In addition, the larger the leasing company, the more open it is to implementing new technologies and using the functionality of the Customer Platform in leasing or a dedicated application on mobile devices. It is also the larger companies that would be more willing to use videoconferencing and leasing processes that are fully automated or handled by a virtual advisor, and they also want to implement digital signature sooner. On the other hand, digitalized after-sales service in the leasing process is the target of all companies, and more than 80% of them would implement digital solutions at this stage.

Digital transactions and digital signature in leasing in 5 years?

It is obvious that without a signature, no contract will be completed. The need to do this quickly and digitally should be equally obvious in today’s age of digital acceleration. The digital signature is a tool to streamline and speed up all leasing transactions. However, security concerns and old habits still hold back its implementation. So, what are the prospects for digital transactions in the leasing industry? And is five years a long or short time?

Nearly half of the respondents to the ICAN Institute survey (43%) use digital signatures when signing leases (it is more often the case for large companies). The remaining respondents (57%) intend to use such a signature within five years. Representatives of large companies show a greater ability to adapt the new technology in this area as well. And what is holding the smaller market players back? The key barriers in using digital signature in leasing are:

- costs,

- attachment to traditional solutions,

- lack of confidence in such technologies, as well as a lack of technical capabilities to use the solution.

A new opening for the leasing industry – lease-sharing

Digital acceleration in leasing provides us with both quite a few challenges and new opportunities. One is the possibility of a lease-sharing platform and the growing need to implement such an innovative solution.

Half of the respondents to the quantitative survey in question declared that their company – in order to optimize costs – is willing to share machinery and equipment (65%), cars and other vehicles (52%) and IT equipment (45%) jointly with other companies. An decent market for new solutions… Especially with 63% of respondents admitting that they often struggle with leasing downtime for machinery, equipment and cars lasting more than one month (again, more often in large companies than small ones).

Digital acceleration favors the best

Changes in the leasing industry are irreversible. This is shown by prevailing leasing solutions and services trends and the latest research. This is also confirmed by the experience of companies and leasing experts, who, in addition to the topics discussed above, also forecast the growing role of leasing offers available to e-commerce or self-service in leasing.

How do you find yourself in all this? First, our ebook “Digital Acceleration in Leasing” will help you understand the challenges you have to face as well as the specific needs of your customers at each stage of the leasing process and transaction. Treat yourself with plenty of statistics, conclusions, and recommendations for the leasing sector and its customers 📈💡📊.

Second, don’t wait 3 or 5 years. Stay aware of the digital revolution in the leasing industry, and change your solutions with the right technology partner. The market abhors a vacuum. In the coming years, eLeasing will be won by those companies that will implement new technologies and modern communication platforms (such as our LeaseTech Customer Platform) in the fastest and most efficient way. Thanks to remote sales channels in leasing, innovative solutions, and clever automation, even a digital leasing consultant can establish a real and lasting relationship. We’ve been developing innovative leasing solutions for years, systematically modifying them to meet the needs of our business partners and your customers. Find out why they choose us.

Author’s note: This article was created thanks to the close cooperation with #AilleronExperts from LeaseTech and based on ebook “Digital Acceleration in Leasing”.

Polski

Polski Deutsch

Deutsch