After years of anticipation, Poland’s leasing industry is stepping into a new era of transformation. July 13, 2025*, will mark a milestone for the entire industry—a significant legal amendment will come into effect, allowing contracts to be concluded not only in paper form or with a qualified electronic signature, but also in documentary form. The first deregulatory package, prepared by the Ministry of Economic Development and Technology, allows, among other changes, leasing agreements to be concluded using electronic communication channels such as e-mail or SMS.**

This marks a breakthrough change, as until now, under Article 709(2) of the Polish Civil Code, leasing agreements could only be concluded and amended in traditional written form, otherwise deemed invalid. For customers, this meant that every agreement, as well as any amendments, had to be signed either in person at a leasing company branch or using a qualified electronic signature. For many lessees, this requirement posed a significant inconvenience, leading to additional costs and considerable delays in finalizing transactions. In practice, it involved printing, manually signing, and sending multi-page documents—a time-consuming process, especially at scale. The same tedious procedure had to be followed for any changes to the agreement, from minor corrections to full annexes.

For companies located outside major urban centers or operating entirely remotely, the entire process was particularly burdensome, often leading to delays in executing investment plans and missing business opportunities. This is why representatives from the leasing sector, with the support of the Polish Leasing Association (Związek Polskiego Leasingu, ZPL), have long advocated for updating the regulations to reflect the realities of a digital economy. They have consistently pointed out that the existing legal framework is impractical and out of step with today’s market landscape.

In an age of increasing process automation, such legal provisions are seen as outdated. It’s especially striking given that leasing—one of the most commonly used asset financing methods in Poland—remained the only financial service that could not be fully concluded electronically, unlike loans, credit, deposits, factoring, bank accounts, or savings accounts.

Leasing Deregulation—Why Do Customers Want to Conclude Agreements Online?

According to the report “Digital Acceleration in Leasing” prepared by ICAN Research for Ailleron, leasing is one of the key sources of financing for entrepreneurs in Poland. It plays a particularly important role in the SME sector, which uses it to finance as much as 75% of vehicle, machinery, and equipment purchases. Since SMEs account for 99.8% of all businesses in Poland, the digitalization of the leasing sector plays a vital role in the continued growth of the national economy.

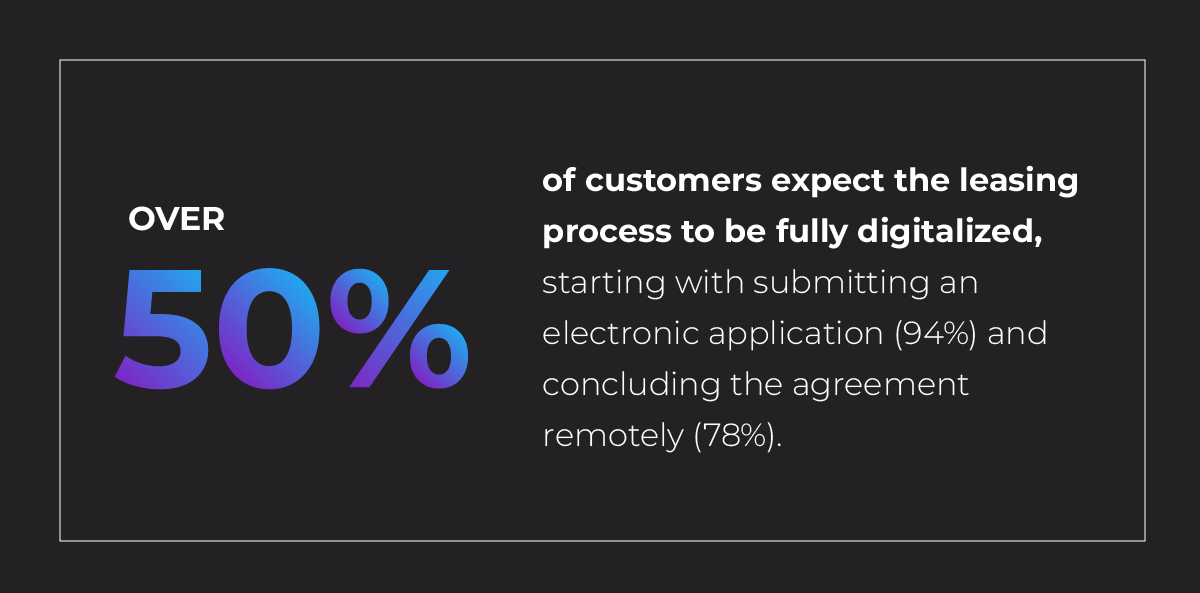

It’s also worth mentioning the results of a recent customer satisfaction study on the leasing process carried out by the Polish Leasing Association together with its member companies. These insights were presented at the 7th annual e-Leasing Day conference, with Ailleron as a strategic event partner.

We’ve observed that customers perceive the leasing process as more digitalized compared to previous years, as confirmed by the growing use of online tools. This positive trend is the result of implementing modern technologies such as artificial intelligence and machine learning, which streamline creditworthiness assessments and accelerate decision-making processes.

In fact, the leasing application stage received the highest customer satisfaction rating, with 59.7% of respondents giving it positive feedback. At the same time, the study highlights a decline in satisfaction regarding the overall duration of the procedure and the complexity of formalities—21.8% of respondents pointed to this factor as an area requiring improvement. Noticeably lower ratings were also given to pricing conditions and the volume of necessary documentation, which further underlines the need for continued simplification of procedures.

We hope that allowing leasing agreements to be concluded in documentary form will be the first step in a broader deregulation process—ultimately leading to a more streamlined and faster leasing experience in Poland. Satisfaction levels will undoubtedly continue to rise.

What Opportunities Does Leasing Deregulation Bring?

Leasing deregulation in Poland marks a new chapter in the financial market’s functioning, sparking both excitement and questions about its consequences. Simplified regulations, increased service availability, and a more liberalized supervisory framework could be a driving force for the entire sector. However, behind this deregulation, are there real advantages, or is it just an empty promise? Let’s take a closer look at the potential opportunities this process brings – not only for leasing companies but also for entrepreneurs and the economy as a whole.

| Benefits of Market Deregulation for Lessees | Benefits of Market Deregulation for Lessors |

| Increased Digital Accessibility of Services | |

| The documentary form in leasing is a viable alternative to the strict written form previously required for signing contracts, a requirement that, for many entrepreneurs, has been a barrier complicating and prolonging the entire process. | Until now, leasing agreements could only be concluded in written form. While the regulations also allowed for the use of qualified or biometric signatures, in practice, these options were rarely used by SMEs, the primary users of leasing services. |

| Minimization of Operational Costs | |

| Lessees will benefit from greater convenience and time savings, as there will no longer be a need for in-person visits to branch offices. They will also reduce expenses related to travel to the leasing company’s location. | Digitalization will enable leasing companies to cut operational costs related to document storage, customer service, and printing and paper purchases—all of which could contribute to more competitive offer terms. |

| Streamlined Economic Trade | |

| A convenience that has long been standard for banking customers—the ability to sign agreements via mobile apps and online platforms—will finally become available to leasing customers as well. | Giving the green light to the documentary form will greatly enhance comfort for more than a million lessees. End-to-end digitalization will not only accelerate the leasing process but also make business transactions safer and more efficient. |

| Improved Customer Experience | |

| A simpler, faster, and more user-friendly contract processes, especially for micro and small business owners who do not use qualified electronic signatures. It’s also a major convenience when making later adjustments, such as annexes or corrections to the agreement. | As highlighted in the Polish Leasing Association’s report “Leasing on the Path of Transformation: 30 Years of Powering the Economy,” by 2030, online channels are expected to become the main battleground for competition, potentially reducing the role of the dealer channel and increasing the importance of self-service models. Introducing the documentary form in leasing is a step toward simplifying processes for customers who value the flexibility of digital solutions. |

Introducing the possibility of remote signing lease agreements not only brings greater convenience and time savings but also measurable environmental benefits. Reducing paper documentation in the leasing sector is a significant step toward a more sustainable business model and the eco-friendly transformation of financial services.

Leasing is no longer one of the last financial services that cannot be fully completed online, directly through the leasing company’s or its partner’s portal or app. Thanks to the documentary form in leasing, customers will now have the ability to sign agreements in a way that aligns with their digital habits.

Digital Solutions Supporting the Documentary Form in Leasing

The digitalization of leasing is no longer an option—it has become a necessary condition to increase business competitiveness effectively. Introducing the documentary form in leasing agreements opens up vast opportunities for the development of digital tools that enable secure, remote contract signing, amendments, and complete online customer support.

In response to this market shift, Ailleron offers the LeaseTech Offer Manager (LOM), a solution fully aligned with the new legislative changes and ready to support the digital conclusion of leasing contracts. The system supports the entire digital customer journey—from submitting an interactive application and configuring an offer to remotely concluding the agreement, eliminating the need for an in-branch visit. Through LOM, the customer advisor can seamlessly manage the entire transaction remotely, including preparing and delivering personalized offers, collecting required data, and finalizing the transaction with a documentary contract.

Everything happens online, ensuring both convenience and fast, efficient service. The leasing advisor will provide the customer with a personalized online offer, allowing them to self-select the optimal option and finalize the contract within a few minutes. This solution fits perfectly with the ongoing deregulation of the leasing market in Poland, offering not only flexibility and process optimization but also comprehensive digital service—from submitting an interactive application and configuring the offer to automated communication with potential clients, and finally, the complete online signing of the contract (e.g., via SMS), along with secure payment of the upfront fee via mechanisms such as pay-by-link (PBL).

The process is designed to be as simple and intuitive as possible, ensuring that the user experience is not only legally compliant but also “smooth and pleasant”—exactly what today’s customers expect. This solution integrates seamlessly with widely trusted platforms, such as Polish mObywatel 2.0, which is already used by over 9.7 million people. As a result, identity verification can be completed free of charge within a familiar digital environment without unnecessary barriers or delays.

Leasing companies have little time left to adapt their systems and procedures to the new legal requirements. That’s why it’s essential to act now and choose a trusted technology partner who can guide the organization through this transformation efficiently. Partnering with a reliable provider like Ailleron ensures a smooth rollout and helps businesses quickly align with the upcoming changes.

It’s worth emphasizing that, while introducing the documentary form may require initial expenses, in the long term, this investment could yield returns by reducing operational costs.

Would you like to explore the full capabilities of the LeaseTech Offer Manager for remote leasing agreements?

Read moreSources:

*Polish Leasing Association, Presentation of the Compendium and Industry Debate on the Documentary Form, leasing.org.pl, [online], accessed June 30, 2025.

**Ministry of Economic Development and Technology, We Keep Our Word – First Deregulation Package Adopted by the Polish Parliament, gov.pl, [online], accessed June 30, 2025.

***Polish Leasing Association, Customer Assessment and Needs in the Digitalization of the Leasing Process, survey results conducted in 2024 among leasing company clients, [online], accessed June 30, 2025.

Polski

Polski Deutsch

Deutsch