About the client:

A universal bank that has been operating in one of the CEE countries for about 20 years, serving retail, consumer finance, agricultural, small and medium-sized enterprises, and corporate banking.

Challenges

Due to dynamic growth and scale of operations, the bank identified several business challenges concerning the data architecture.

Regarding aggregated data, growing internal demand for:

real-time data for operational and analytical purpose

better access to data

new data sets for business users

taking advantage of unstructured data

Next-generation Customer Data Platform to the rescue

Financial companies today face a rapidly growing volume and variety of data. Additionally, financial service decision-makers need support to meet

- the challenges of high costs

- the complexity of implementing and managing traditional databases

- the growing competitive landscape

All this requires a next-generation data platform that

- can adapt to meet the most demanding requirements

- is cloud-ready

- scales to meet growing business needs

- is able to adjusts to both transactional and analytical workloads.

The bank decided that current data access by enterprise document management (EDM) doesn’t meet the requirements of a modern digital bank. After evaluation of solutions available on the market, the bank had chosen to build a Customer Data Platform (CDP) with Ailleron.

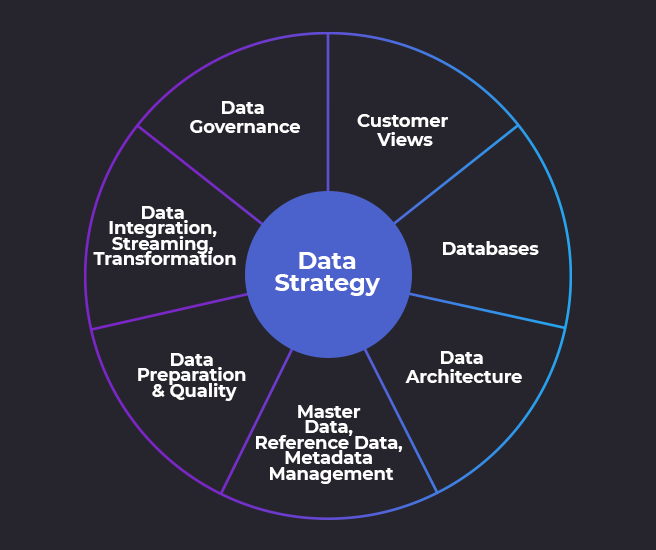

Ailleron solution for a next-generation data platform

Ailleron Customer Data Platform (ACDP) is a set of tools and technologies that create a comprehensive solution for processing and managing data from various systems.

Our offer was accepted due to:

- flexibility concerning the supported technologies and alignment with the bank’s corporate technology stack

- detailed architecture of ACDP with a clear vision of solving bank’s business & IT challenges

- readiness for a quick start – in only 2 weeks from bank’s approval decision

- availability of experienced specialists – we employ both software development and financial business experts with +10 years of hands on experience & domain background

Main ACDP use cases:

- Providing data for Personal Finance Manager (part of client’s Digital Banking Platform)

- Providing data for 360 Customer Views

Scope of data processed by ACDP includes:

- All customers’ transactions with categories

- Customer personal data

- Products

Main components of ACDP provided during the project

Data Streaming

Core component of ACDP responsible for:

– gathering events and data from source systems (events, CDC Connectors, etc.)

– distribution of events within the whole platform

– data transformations

Data Lakes

Storing data from various sources for analytics purposes:

– data lake with raw data

– data lake with enhanced data

Operational Data Stores (ODS)

ODS are used to store optimized data for external systems (like Internet / mobile banking, CRM, back office applications). In this case, they store domain data like:

– transactions

– products

– customers

– etc.

GraphQL

Provides read-only API and is responsible for aggregation of data from 1 or more ODSes for particular customer views

API Gateway

– Takes all API calls from clients and routes them to the appropriate microservice

– Provides security and access control

Data Hub

Component responsible for data discovery, data governance, metadata management, and data lineage; allows for

– adding tags to data

– describing data attributes

GDPR

Component responsible for data anonymization (when it is required by bank)

Implementation

The project is being carried out in

- agile methodology

- strict cooperation with the bank, including daily meetings & statuses

Crucial roles among Ailleron Team include:

- Data Platform Architects

- Data Engineers

- Data Platform Developers

- Data Analysts

Ailleron Team scaled up from 4 FTE to 12 FTE in just 3 months.

ACDP tech stack used in the project

- MongoDB

- Kafka Confluent

- Apache Spark

- Prometheus

- Graphana

- Delta Lake

- OpenSearch

- Zipkin

- Vault

- Fluent ID

- kStream

- Aqhq

- Oracle

- Java

- PySpark

- ksql

Let’s make financial experiences

easy and enjoyable together!

Tell us what you need and we will contact you shortly.

Polski

Polski Deutsch

Deutsch