In the previous two articles, we explored the importance of accountability to both consumers and regulators when developing GenAI-based tools. We also briefly outlined the challenges posed by the upcoming EU AI Act and the role of transparency in managing clients’ often overly ambitious expectations toward AI-powered solutions.

For part three of our series, we’re taking a more unexpected angle—making the case that, despite all the hype, GenAI isn’t the full picture. We’ll spotlight under-the-radar applications and revisit the strengths of traditional machine learning, showing how the broader AI & ML toolkit still holds powerful, practical value.

Table of Contents

- GenAI Use Cases in Banking That Go Beyond Text Generation

- Unobvious Applications and the Role of Traditional ML

- Traditional ML as Still Effective and More Cost-Efficient Tool

- Prompt Engineering, Fine-Tuning, and Retrieval-Augmented Generation (RAG)

- Choosing the Right Technological Solution for a Specific Business Case

Read more articles in this series

Ailleron and Ab Initio Software on AI: Data Monetization and…

Generative artificial intelligence holds tremendous potential for the financial industry, but its implementati…

Ailleron and Ab Initio Software on AI: Promises vs. Reality …

The Value of Evolutionary AI Implementation in Finance Exaggerated KPIs and the Transition from the “AI Hyp…

Ailleron and Ab Initio Software on AI: From Excitement to Re…

The vast potential of artificial intelligence, especially generative AI, has taken center stage at business an…

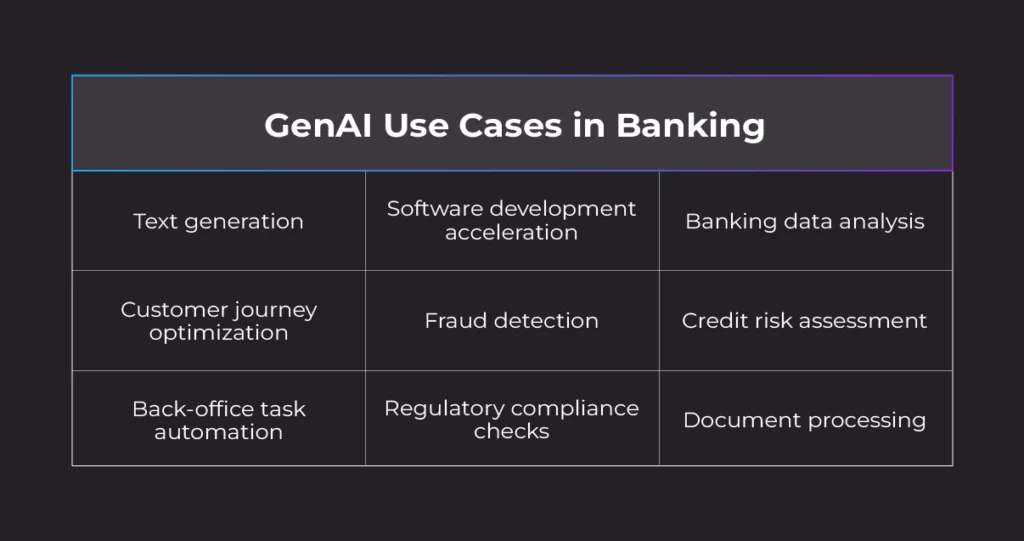

GenAI Use Cases in Banking That Go Beyond Text Generation

Generative AI has gained widespread attention primarily due to its remarkable ability to produce human-like text, as well as images and videos created through prompts that anyone can input, even without professional experience in advertising or design.

However, the applications of GenAI in the financial sector go far beyond content generation. They range from code automation and data analysis to the optimization of entire business processes. For example, this technology can be used to streamline the whole customer journey by predicting and deliberately shaping each step of a client’s interaction with the bank.

Generative AI can also revolutionize how financial institutions approach risk management by improving the efficiency, speed, and effectiveness of compliance and risk oversight processes. Traditional risk management systems relied primarily on predefined rules and structured data, such as transaction records, which limited their flexibility and effectiveness in identifying emerging or unconventional threats.

One of GenAI’s key advantages is its ability to interpret and analyze unstructured data, including client-banking advisor interactions, social media content, images, and documents. By combining insights from a wide range of data sources, GenAI can detect early indicators of risk or fraud that conventional systems often overlook. Its strengths in pattern recognition, contextual analysis, and adaptability enable financial institutions to identify threats more quickly and react with precision.

In credit assessment, GenAI models can evaluate non-traditional data sources to support more inclusive and accurate lending decisions.

Operationally, generative AI assists in automating complex back-office tasks, such as document processing, regulatory compliance checks, or contract review—significantly reducing workload and turnaround times.

In software development, it accelerates delivery by generating and validating code, writing test cases, and improving development workflows.

These advanced capabilities enable banks not only to increase efficiency and reduce costs, but also to unlock new levels of personalization and responsiveness in their services. To unlock this potential, banks need to first learn how to describe their business processes in a structured way and gather the necessary historical data. In other words, implementing GenAI successfully requires not just technological expertise but also a deep understanding of the processes it’s meant to enhance.

Unobvious Applications and the Role of Traditional ML

Let’s not forget that generative AI is just one of many tools available on the market. Today, financial institutions are feeling the pressure – and the competitive heat – to launch pilot projects using this technology. However, as Michał Walerowski, AI & Data Solutions Manager at Ailleron, points out, the rush to adopt cutting-edge innovations often overshadows the value of proven, “traditional“ machine learning methods. These established solutions remain highly effective for tasks such as customer segmentation, fraud detection, and credit scoring. Traditional ML continues to offer strong performance at a lower cost for financial institutions.

There are some particularly interesting use cases of GenAI that go well beyond simple text generation. By “text generation,” I also mean tasks like summarizing multiple documents into a single coherent text. If we look at the underlying technology, it’s a specific type of neural network called a transformer neural network. What transformer neural networks are good at is understanding sequences of events and figuring out how to generate a sequence of events in order to optimize it for a specific goal. So, a sequence of events can be a sequence of words in a document, which is why the text is a good example while discussing GenAI’s capabilities. It can also be a sequence of keywords in a programming language, variable names, and so on.

Traditional ML as a Still Effective and More Cost-Efficient Tool

Most organizations are already utilizing GenAI to some extent for various purposes, not just text generation. This technology allows for a fresh perspective on business processes, enabling the planning of actions that optimize each sequential stage to achieve the desired goal.

As mentioned before, AI requires a training dataset to operate effectively. It’s crucial for the AI model to understand what actions to take based on historical data. This means that the bank must be able to collect data on all previous customer journeys. Next, the bank, in cooperation with a solution provider, needs to label all these events and states and use them for training.

It’s not necessary for banks to build their own large language model, as this practice is highly costly. An alternative is to leverage an existing large language model and fine-tune it using their own data.

Prompt Engineering, Fine-Tuning, and Retrieval-Augmented Generation (RAG)

Fine-tuning or domain-specific training accounts for less than 2% of the cost of building a large language model. Instead of building a large language model, I would consider domain-specific training or retrieval-augmented generation (RAG). The latter allows for creating vectors from existing data to reduce hallucinations and improve model performance.

As Stephen Brobst reports, referencing a case study from Ab Initio Software, one of their clients implemented mechanisms that enabled hyper-personalization, providing each customer with a highly unique journey from a marketing perspective. This example can also be translated into other business processes.

According to an expert from Ab Initio Software, organizations are often willing to begin pilot projects in marketing because the risk of failure is lower, and marketers are generally more open to this kind of innovation.

My first choice is prompt engineering—we apply prompt engineering to guide the model with an understanding of the data. However, prompt engineering alone is probably not sufficient for all the types of use cases I’m referring to, which is why it’s also worth exploring RAG capabilities. There are also many other techniques that can be used to achieve strong results when working with large language models.

Choosing the Right Technological Solution for a Specific Business Case

It’s equally important to raise awareness that GenAI is just one of many tools available for tackling a variety of challenges. Older techniques often remain highly effective, even if they no longer take center stage at industry events.

If you’re serious about using AI/ML effectively, it’s essential to take advantage of the full toolbox rather than relying on a single technique.

Our clients want to meet to explore our use cases and discuss GenAI capabilities, and we often end up talking about customer segmentation or company-wide applications. I explain that the given case wasn’t resolved using GenAI, but we can still address the similar issue effectively with traditional AI. Yes, conventional machine learning will still be faster in certain specific cases. When we discuss artificial intelligence, we require high-quality data to deliver robust, analytics-driven solutions.

In wrapping up our discussion on selecting the right technological solution for a specific business scenario, we conclude our publication series with an article that addresses the highly debated issue of monetizing the untapped potential of data. We’re all aware that, although banks have access to huge amounts of data, they’re not fully capitalizing on it. We’ll examine why this is the case and explore ways to overcome it.

In our next article, you’ll find out more about:

- What are the main challenges preventing financial institutions from monetizing data at scale?

- Is organizational transformation truly the foundation of AI success?

- Agility, commitment, and the willingness to continuously learn and adapt to new challenges as future competencies